Markets aren’t chasing headlines; they’re pricing in structural uncertainty. Gold is exploding higher on safe-haven flows while oil drifts sideways, caught between fading geopolitical premiums and stubborn supply reality. This divergence screams caution: protection over growth bets.

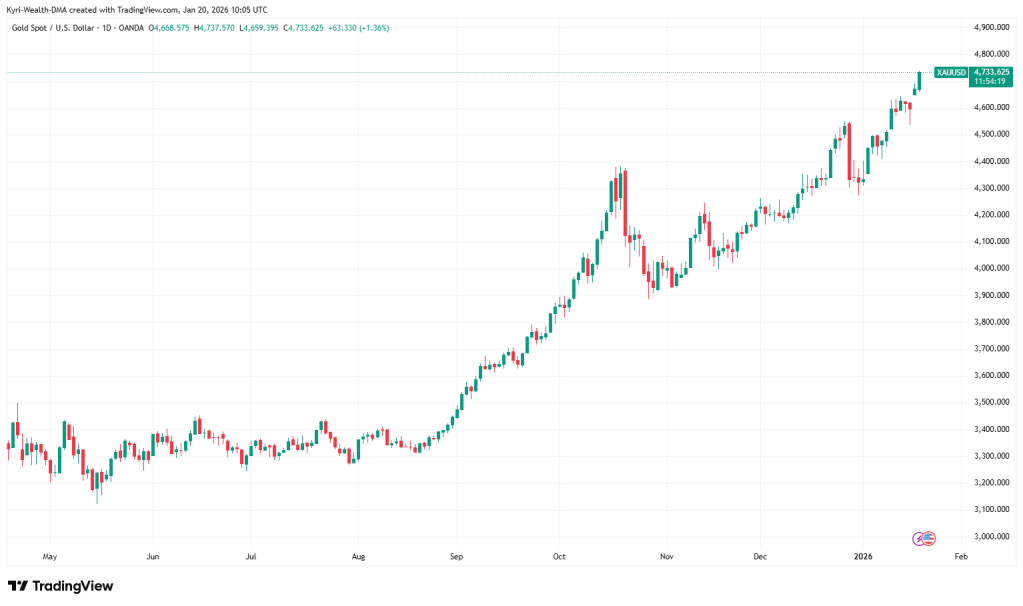

Gold: Record Highs as Policy Fragmentation Accelerates XAU/USD hit fresh all-time highs above $4,733 today.

The move isn’t random—it’s a clear vote for gold as the ultimate non-political asset in a world where trade policy is weaponised.

Key drivers stacking up:

- Trade & Tariff Escalation — Trump’s weekend announcement of 10% tariffs on eight EU nations (Denmark, Norway, Sweden, France, Germany, Netherlands, Finland, UK) effective Feb 1 (potentially 25% by June unless Greenland deal) has reignited fragmentation fears. Europe preps retaliatory levies on €93bn US goods; Davos now feels like a risk event. Gold thrives when policy predictability erodes.

- Safe-Haven Acceleration — Risk-off sentiment dominates: capital flees growth-sensitive assets. Geopolitical noise (lingering Venezuela/Iran headlines, even if eased) adds premium.

- Rate & Dollar Dynamics — DXY slipping toward 98.49 (-0.9% today) amid softer Fed path expectations (low odds of near-term cuts, but easing priced deeper into 2026). Lower real yields make non-yielding gold more attractive.

- Structural Bid — Central banks keep buying (70+ tons/month average expected); institutional demand ignores short-term vol.

Takeaway — Gold isn’t “overbought”—it’s repricing open-ended uncertainty. The chart shows relentless upside momentum since late 2025, with today’s candle confirming buyers defend every dip. This is defensive positioning at scale.

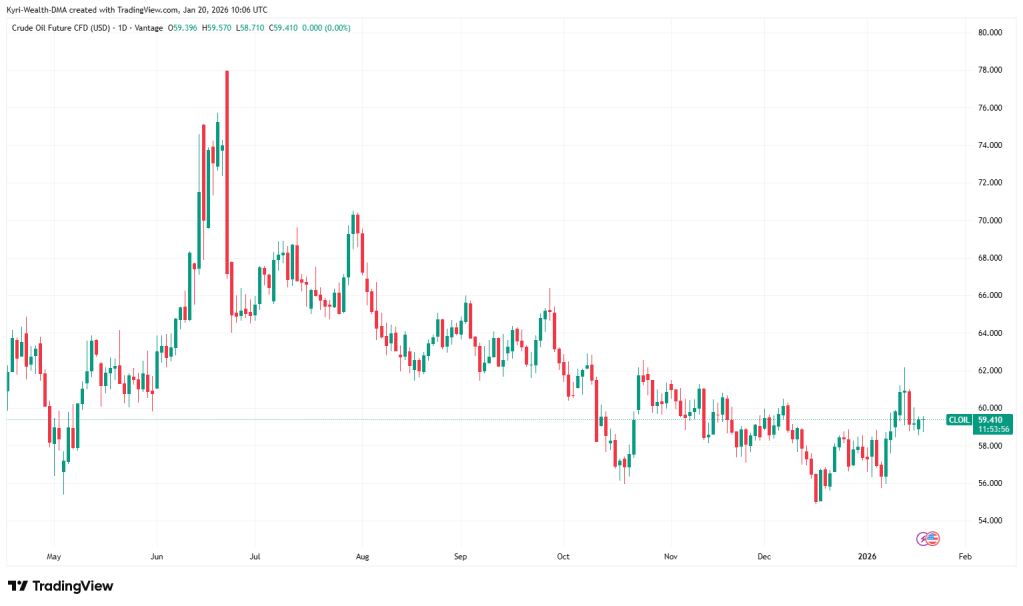

Oil: Steady But Fragile – Growth Floor Meets Supply Ceiling Crude (your Vantage CFD: ~$59.41 flat, 0% change) refuses to break out, hovering near $59–60 after last week’s volatility.

Brent around $63.80–64. No explosion despite headlines—supply remains ample, demand resilient but not roaring.

Drivers in balance:

- Geopolitics Fading Premium — Iran/Venezuela/Black Sea tensions (e.g., Kazakh export disruptions) provided temporary lift, but no sustained Strait of Hormuz threat or major outage. Trump’s Greenland/EU focus shifts risk narrative away from energy chokepoints.

- Supply Still Ample — OPEC+ steady output, non-OPEC growth (US, South America), inventories building (EIA forecasts ~2.8mb/d global build in 2026). No compliance cracks yet.

- Demand & Growth Signals — China Q4 GDP beat expectations; industrial resilience provides floor. But trade wars (US-EU tariffs) cloud demand outlook—energy consumption tied to real activity.

- Inventory/Seasonal Context — Recent builds reinforce oversupply narrative; seasonal patterns limit sharp moves without catalyst.

Takeaway — Oil is in classic wait-and-see: grounded by fundamentals, sensitive to headlines but not exploding. The chart shows range-bound action post-summer peaks, with $58–60 as current battleground. No collapse, but no conviction rally either.

Cross-Market Lens

- Risk Split — Gold’s surge = protection mode; oil’s stability = growth hasn’t broken yet. Classic macro divergence.

- Dollar & Rates — Weaker DXY aids gold, pressures dollar-linked oil. Fed independence under scrutiny amid political noise.

- Overarching Themes — Trade policy as foreign policy; central bank autonomy at risk; energy security vs. ample physicals. 2026 feels like fragmentation accelerating—gold wins on caution, oil needs clear demand/supply shift.

Narratives to Track This Week

- Tariff rhetoric → action (EU response, Davos fallout).

- Central bank signals (Fed independence, any policy pressure).

- Growth data (US PCE delayed, China follow-through).

- Energy flows (OPEC compliance, inventory reports, Black Sea updates).

Final Thought

Gold and oil are narrating two sides of the same macro coin: caution dominates, growth holds but doesn’t inspire. Understanding this split isn’t about calling the next candle—it’s about seeing what the market truly fears (and what it doesn’t). Prep accordingly: bias toward resilience in uncertainty.

This is education and context only. KyriWealth provides no investment advice, trade ideas, or signals. Trading involves substantial risk of loss—use demo accounts, size positions conservatively, and never risk what you can’t afford.

Leave a comment