Commodity markets head into the coming week with attention firmly on macro direction rather than short-term volatility. Gold and oil remain key reference points for how investors are interpreting inflation, growth prospects, and geopolitical risk.

What makes this week notable is not a single headline event, but a cluster of economic data and central-bank signals that could shape expectations. For investors and commodities brokers, the focus should be on how markets react to information, not just the information itself.

Below, we look at what to expect from gold and oil, and which scheduled events may influence sentiment.

Gold: Policy Signals and the Mood of Markets

4

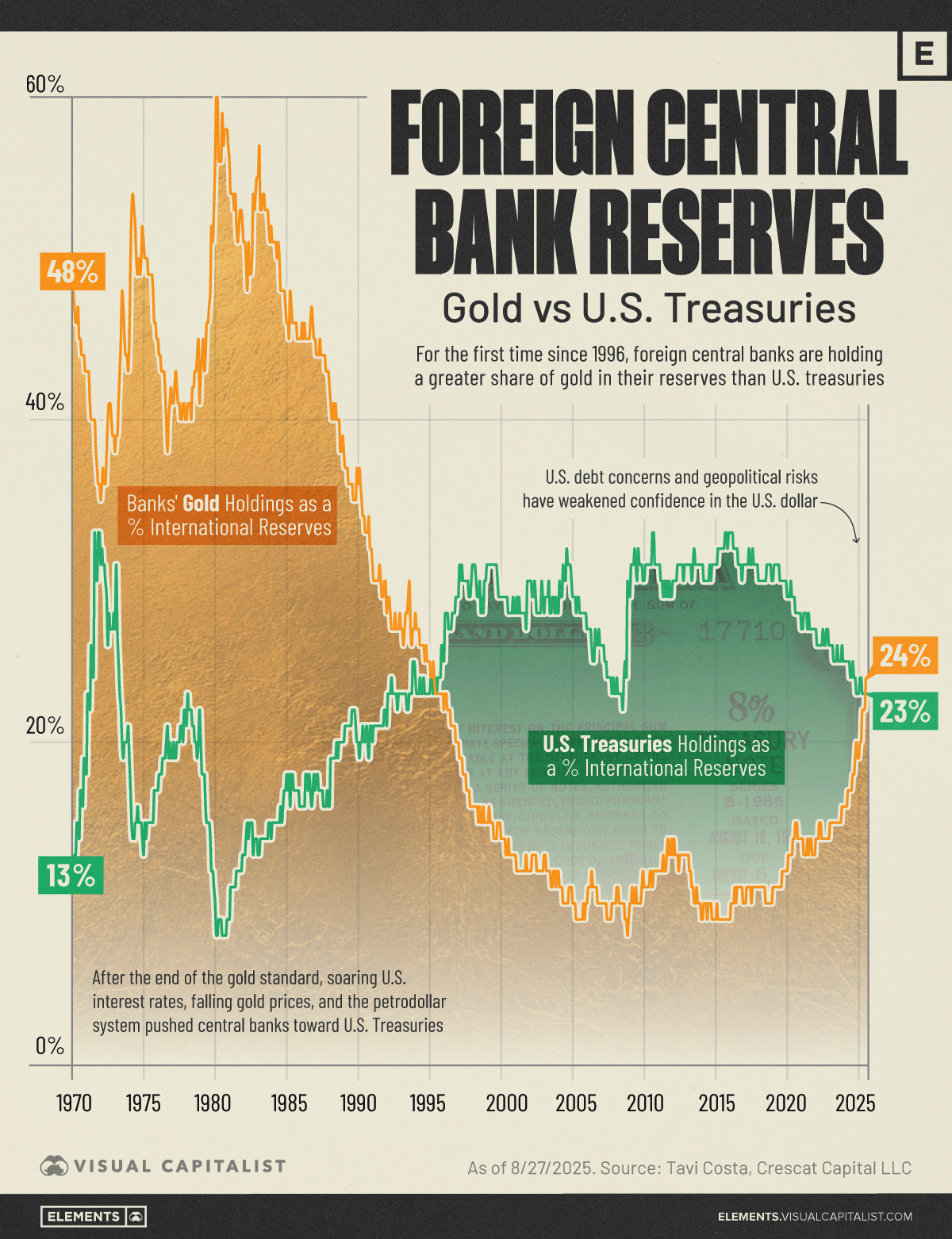

Gold enters the week as a barometer of confidence in monetary policy and economic stability.

What may influence gold this week

Central bank messaging is critical. Several major economies release inflation and activity data that could shape expectations around interest-rate policy. Markets will be listening closely for confirmation that policymakers feel inflation risks are under control — or whether caution still dominates.

US inflation data stands out. The release of the Federal Reserve’s preferred inflation gauge later in the week has the potential to influence bond yields and the US dollar. A calm reaction would suggest confidence in the policy path, while volatility could renew interest in gold as a stabilising asset.

Economic momentum matters as much as inflation. Growth indicators such as business surveys from the US and Europe may affect whether markets lean toward optimism or caution. Gold often benefits when growth signals weaken, even if inflation is easing.

Geopolitics remains a background support. While no single flashpoint is dominating headlines, unresolved tensions continue to underpin interest in assets perceived as politically neutral. Gold tends to respond more to persistent uncertainty than to short-lived events.

What to watch

This week, gold is likely to respond to:

- Changes in bond-market expectations following inflation data

- Currency reactions to central-bank commentary

- Whether broader markets display confidence or caution

Gold is less about excitement and more about what investors are quietly worried about.

Oil: Demand Signals Take Centre Stage

4

Oil markets head into the week focused on whether demand expectations can justify current supply conditions.

Key drivers this week

Global growth data is crucial. China releases major economic indicators early in the week, including activity and growth figures. These are closely watched for what they imply about industrial demand and transport activity — both central to oil consumption.

Business surveys add colour. Flash manufacturing and services indicators from the US and Europe later in the week will help markets assess whether economic momentum is improving or fading. Oil tends to respond to the direction of demand expectations rather than absolute levels.

OPEC+ remains a steady influence. There is no scheduled producer meeting, but ongoing commentary around supply discipline continues to shape sentiment. Markets are assessing not just policy decisions, but confidence in producer coordination.

Inventory data provides confirmation. Weekly oil stock figures from the US will act as a reality check, helping investors judge whether the physical market aligns with demand narratives.

Geopolitical and shipping risks persist. Energy markets remain sensitive to developments affecting transport routes and regional stability, even when no immediate disruption occurs.

What professionals should watch

Oil this week may be shaped by:

- The tone of China’s growth data

- Signals from global business surveys

- Inventory trends versus demand expectations

Oil is increasingly about credibility — whether supply restraint and demand growth appear sustainable together.

Cross-Market Signals: How Gold and Oil Fit the Bigger Picture

4

Gold and oil together offer insight into broader market psychology.

- Equities: Strong equity sentiment often supports oil through growth optimism, while reducing the appeal of defensive assets.

- Bonds: Bond yields remain central. Rising yields can challenge gold, while falling yields often support it.

- Currencies: Currency moves influence both commodities and reflect confidence in economic policy.

- Risk appetite: Oil tends to thrive in “risk-on” environments; gold benefits when uncertainty rises.

Watching how these markets interact can be more revealing than any single data release.

Key Events and Data to Watch This Week

Without focusing on exact outcomes, several scheduled releases may influence commodities sentiment:

- China: Growth and activity data early in the week, plus a central-bank policy update

- United States: Business surveys and inflation data closely linked to interest-rate expectations

- Europe and the UK: Inflation and labour-market figures that shape monetary-policy confidence

- Energy markets: Weekly US inventory data and ongoing producer communication

These events may not cause immediate moves, but they help define the narrative markets carry forward.

Market Narratives Taking Shape

As the week unfolds, markets may focus on broader questions:

- Is global growth stabilising or continuing to cool?

- Are central banks confident, or simply waiting for clarity?

- Can oil demand meet expectations without new supply stress?

- Does lingering geopolitical uncertainty continue to support gold?

These themes often matter more than any single headline.

Final Thoughts

The week ahead in commodities is about interpretation rather than prediction. Gold reflects trust — or doubt — in monetary and political systems. Oil reflects belief in global growth and supply discipline.

For investors and commodities professionals, the key is not to react to every release, but to observe how markets absorb information. In doing so, gold and oil remain valuable guides to the underlying mood of the global economy.

Leave a comment