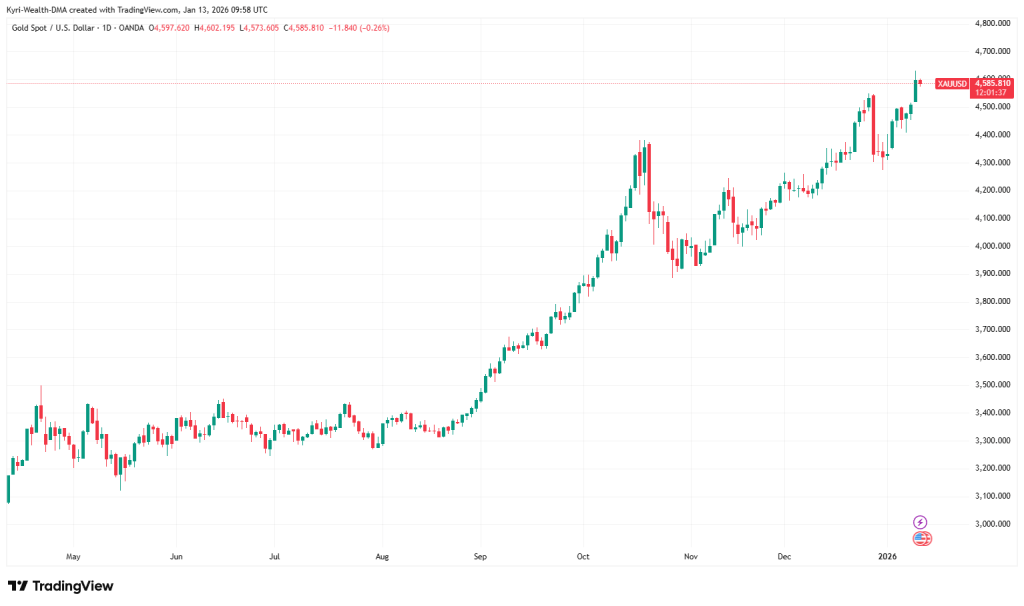

Gold is consolidating just below Monday’s record high near 4,630 as London opens.

Today’s daily Gold update focuses on US CPI, bond yields, and central-bank credibility.

Key Gold levels today sit around 4,575 support and 4,610–4,630 resistance for XAUUSD.

Macro

Gold has surged to fresh record territory, briefly touching above 4,620 before easing as investors booked profits.

The broader backdrop is still dominated by geopolitical tension and unease about global central-bank independence.

A criminal investigation into the Federal Reserve chair has sharpened questions around policy autonomy and the dollar.

At the same time, global equities are near highs while US futures lag ahead of key inflation data.

The US ten-year yield trades around the low-4% area, keeping real yields in focus for Gold.

Non-yielding assets tend to benefit when rates look capped and when political risks stay noisy.

Today’s Gold price analysis at the London open is therefore less about trend and more about event risk.

US CPI will help decide whether yields push higher again or allow XAUUSD forecast ranges to remain elevated.

Levels

Gold trades just under 4,600 this morning, steady after Monday’s spike to a new record.

Price action suggests consolidation rather than reversal, but the range is tight into the CPI release window.

Key Gold levels today:

- Support 1 – 4,575

This level marks the lower edge of the overnight band and yesterday’s intraday floor.

If London keeps XAUUSD above 4,575, it signals dip buyers still defend shallow weakness into the data. - Support 2 – 4,545

A cleaner shelf on intraday charts and close to the last breakout zone.

A sustained move below 4,545 would hint at heavier profit-taking after the parabolic run higher. - Resistance 1 – 4,610

Local intraday cap since the record high was printed.

If price reclaims and holds above 4,610 before CPI, traders appear comfortable carrying upside exposure into the release. - Resistance 2 – 4,630–4,650

This band wraps Monday’s record high and a likely pocket for optionality and stop clusters.

A benign CPI print and softer yields could see a squeeze through 4,650, though follow-through needs confirmation.

For this daily Gold update, the behaviour around 4,575 and 4,610 matters more than any single headline.

Human Truth

Most traders lose money predicting the number; more survive by respecting how Gold reacts once it prints.

Calendar

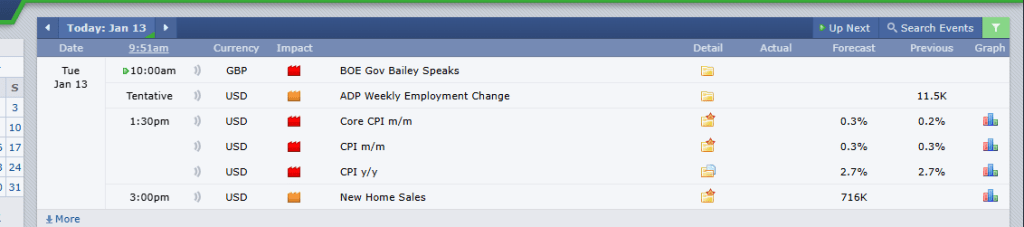

Today’s economic calendar in UK time is clean but loaded.

At 10:00, Bank of England Governor Bailey speaks, potentially stirring gilts and sterling sentiment.

The main focus is the US CPI pack at 13:30, including headline and core readings.

Later, at 15:00, US New Home Sales offer another read on housing resilience, but will likely be secondary for Gold.

A simple ForexFactory-style snapshot in UK time keeps these drivers visible without cluttering the screen.

Wrap + CTA

London steps into a Gold market sitting close to all-time highs, yet clearly hesitant ahead of US CPI.

That mix of strong trend and binary event risk is where discipline either shines or disappears.

The temptation here is to believe you must take a strong directional stance before the number.

In reality, the job is to map scenarios and decide which ones you are willing to live with.

If CPI lands broadly in line with expectations and the ten-year yield holds near current levels or drifts lower,

Gold can probably justify holding above 4,575 and working back into the 4,610–4,630 zone.

In that outcome, the existing narrative barely changes.

Rate-cut hopes stay alive, real yields look contained, and geopolitical noise continues to justify some portfolio insurance.

Volatility may spike around the release, but the underlying character of the uptrend remains broadly supportive.

If inflation surprises on the upside, the chain is different.

Yields would likely push higher, the dollar could catch another bid, and rate-cut timelines may be questioned again.

In that case, how Gold trades into 4,575 and then 4,545 matters more than the headline itself.

A quick rejection from those zones would show positioning remains strong and buyers are prepared to defend.

A clean break and time spent below them would warn that late entrants are being forced to lighten up.

Neither scenario is guaranteed; both can be prepared for.

The geopolitical backdrop remains noisy, from investigations into central-bank leadership to tariff threats and regional tensions.

These stories act more as a slow-burn support for the safe-haven narrative than as intraday timing tools.

What really drives execution decisions is how that anxiety translates into moves in yields, the dollar, and then XAUUSD.

For visuals, two simple graphics can anchor the day’s thinking.

First, a ForexFactory-style calendar panel in UK time, highlighting Bailey’s speech, US CPI, and New Home Sales.

Second, a current Gold chart: XAUUSD daily with Monday’s 4,629 high, the 4,575 and 4,545 supports, and 4,610 resistance marked.

Those images keep attention on where price actually trades rather than where stories say it should be.

The edge rarely comes from nailing the exact CPI print.

It usually comes from knowing your key levels, your risk tolerance, and your behaviour once the dust settles.

What do you personally find harder around days like this – waiting for the number, or managing the move afterwards?

Leave a comment