Inflation, war and weaker US data are pushing capital back into gold fast.

With banks calling for $5k, I still see $5.5k – the question is whether your account is ready.

Macro – pressure everywhere, confidence nowhere

The story is simple. The world feels more expensive, more unstable and more political than it did a year ago.

US jobs are slowing, growth is patchy, yet the cost of living refuses to give ordinary people any real relief.

Central banks talk tough on inflation, but markets already price in cuts when the data finally cracks.

At the same time, we have open wars, trade disputes, and governments loading up on debt like it never matters.

No wonder the big houses now talk openly about gold at $5,000 this year. I am still pencilling in $5,500.

In that backdrop, holding zero exposure to gold looks more like a risk than a comfort blanket.

Levels – Gold, DXY, Nasdaq

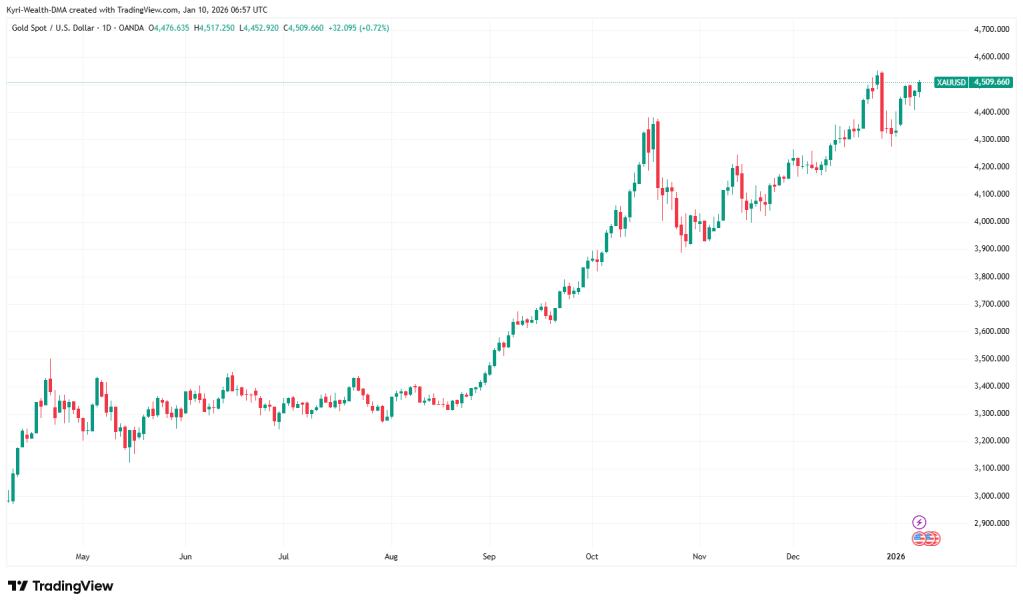

Gold (XAUUSD)

- Price is grinding higher above $4,450 after the latest soft US payrolls print.

- Record high around $4,550 is the first big resistance; a daily close above targets $4,700 next.

- Nearest support sits near $4,400, with a more important line around $4,300 on any deeper flush.

- Trend structure still shows higher highs and higher lows from September – classic bull behaviour.

- Dips linked to brief dollar strength keep getting bought, which tells you who really controls this tape.

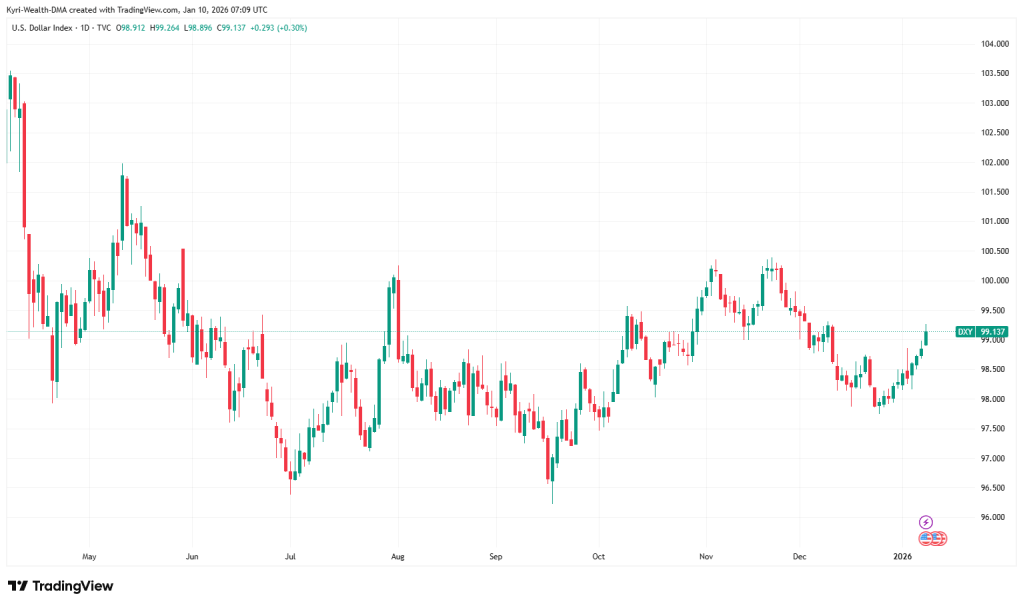

DXY (US Dollar Index)

- Dollar is stuck in a range, fading from recent highs as rate-cut talk grows louder again.

- A move under 98 would confirm a medium-term top and likely fuel another leg higher in gold.

- For now, sideways dollar trade removes some of the headwind that usually caps bullion rallies.

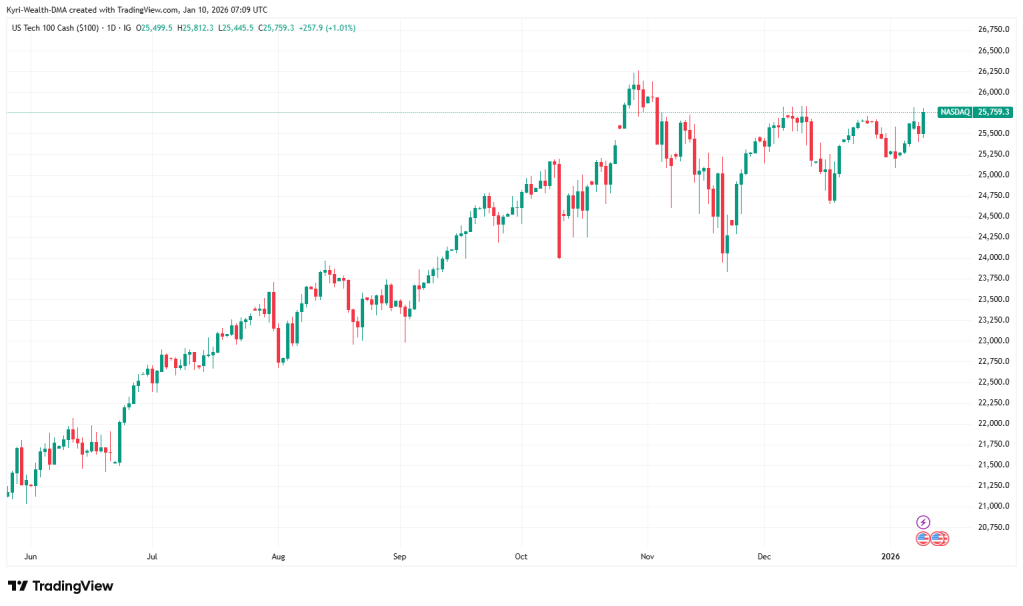

Nasdaq 100

- Nasdaq remains strong, but leadership is narrow and volatility creeps in on every earnings wobble.

- If we finally see a proper correction, forced de-risking could send capital hunting for safer diversifiers.

- In that scenario, gold is one of the few assets that can rally while equities take a hit.

Human Truth

People open trading accounts when fear peaks, but the best conditions usually come weeks before the panic.

Calendar – what matters this week

First, watch the next US inflation print; softer numbers keep the rate-cut story alive and support gold.

Second, track key central-bank speakers for hints on timing and pace of any easing cycle this year.

Third, stay alert to geopolitical headlines around energy routes, sanctions and escalation risks, which remain quietly bullish for hard assets.

Wrap + CTA – why I’d get a Vantage account in place now

Let’s be straight. The combination of inflation, wars and political noise is not going away quickly.

Households feel squeezed, governments feel cornered, and central banks are trying to pretend everything is normal.

Markets see through that. They are rotating, slowly but clearly, back towards assets that do not depend on promises.

Gold sits at the centre of that rotation. It does not pay a coupon, but it also does not miss earnings.

It does not care about elections, party manifestos or late-night central-bank press conferences.

When trust in policy wobbles, gold usually benefits – and that is exactly the environment we are in now.

How you express that view depends on your situation. Long-term wealth builders might split between physical bars or coins and simple gold ETFs.

Physical is slow and old-school, but it is also nobody else’s liability.

ETFs plug nicely into portfolios, giving you clean exposure without vaults or delivery.

Then there is the trading side – where most of my readers live. Shorter-term moves around key data, levels and headlines can be powerful.

To capture those, you want a tight, regulated CFD setup on XAUUSD, not some clunky offshore experiment.

That is why I look at Vantage for trading gold:

- Low, transparent trading costs on gold CFDs, with tight spreads on RAW accounts.

- Global coverage and strong platforms, including MT4, MT5 and mobile, so you can trade from anywhere.

- Fast, reliable withdrawals, because profits only matter when they actually reach your account.

- Proper regulation and risk tools, including negative balance protection and clear margin information.

If you believe, like I do, that this gold cycle has further to run, the logical move is simple.

Get your live trading account open and funded before the next wave of volatility hits the screen.

That way you can act on opportunity with size that fits your risk, rather than chasing headlines in a panic.

You can open a Vantage live account here in a few minutes:

Open your Vantage account now:

https://www.vantagemarkets.com/open-live-account/?affid=NTg0MzU=

Use it to trade gold only when you fully understand the product and your downside.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should carefully consider whether you understand how CFDs work and whether you can afford to take the risk.

Nothing here is personal investment advice; it is how I see the market and the available tools today.

If you are not sure how gold fits into your own plan, ask before you act.

Fancy a quick call? Text/WhatsApp +44 7737 099002 and we will talk through your options in plain English.

Are you going to meet this gold cycle with a prepared Vantage account, or watch it pass you by again?

Leave a comment