The US has grabbed Venezuela’s leader, oil is nudging higher, and gold sits near records.

Risk feels unstable, yet the dollar is only gently basing.

This first full week of 2026 is about what that really means for your FX book.

Macro – Geopolitics on Fire, Markets Half Asleep

The year opens with a US special forces raid lifting Nicolás Maduro out of Caracas and flying him to New York. Washington is openly talking about “running” Venezuela and its oil. Borders are already tightening and the UN Security Council is scrambling for an emergency session.

This lands on top of existing wars and flashpoints – Ukraine, Gaza, Red Sea shipping, Iran–Israel tensions and a generally weaponised energy market. Yet oil has only bounced modestly from last year’s lows, with Brent still in the low sixties after a big fall in 2025.

Gold, in contrast, has surged and now trades near 4,400 after tagging highs just under 4,550. The dollar index sits in the high nineties after its worst run in years.

For FX traders, the picture is clear: geopolitics is screaming, but pricing is only whispering.

Levels – Gold, DXY, Nasdaq

Gold (XAUUSD)

- Spot trades around 4,330 after last year’s explosive rally and a late-December blow-off high.

- First support sits in the 4,270–4,300 band, where the last pullback found buying interest.

- Below 4,270, you invite a much sharper shakeout of late safe-haven buyers chasing headlines.

- On the upside, 4,450–4,550 is the resistance shelf from the final spike; a clean break there needs genuine new fuel.

- For FX, gold is your cleanest read on whether geopolitical fear is finally outrunning the weaker-dollar narrative.

US Dollar Index

- DXY hovers around 98.4, still soft versus last year but no longer in free-fall.

- The 98.0–98.5 range is my pivot; sustained trade below keeps pressure on the dollar theme.

- A squeeze through 99.5 opens room toward 101, which would hurt crowded structural short-dollar positions.

- Watch how dollar trades on Venezuela headlines and oil spikes; that will show whether macro desks genuinely care.

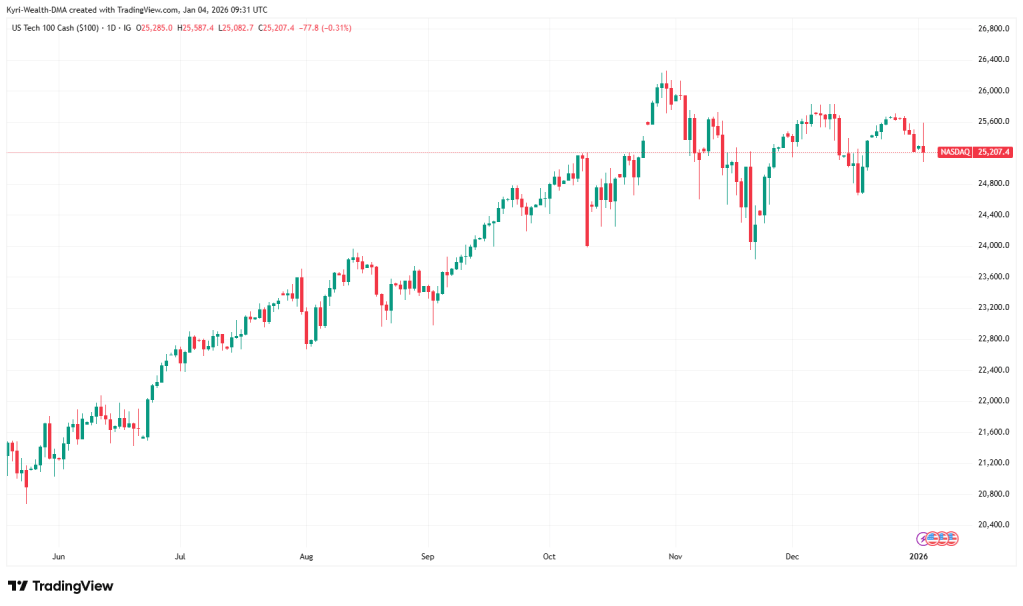

Nasdaq / US Tech 100

- The index trades around 25,200 after a huge 2025 and a messy, choppy final quarter.

- First support comes in near 24,800–25,000; beneath that, 24,200–24,300 is the next obvious demand pocket.

- Resistance sits around 25,600–25,800, where several rallies have stalled as profit-taking hits the AI complex.

- For FX, Nasdaq is still your main “risk switch” for JPY crosses, EM FX and high-beta currencies.

Human Truth

FX traders love geopolitical headlines but rarely map them into precise risk, size and wealth outcomes.

Calendar – What Matters for FX This Week

This week is heavy on geopolitics and policy, not just data. I’m watching the UN Security Council session on Venezuela, the OPEC+ online meeting on production for the first half of 2026, and the first big US labour and inflation prints of the year. Together they will shape whether the dollar’s bounce is real, whether oil’s move has legs, and how long gold can stay this elevated.

Talking to FX Traders in a World on Edge

If you trade FX, this is exactly the environment you claimed to be waiting for.

You have a US administration openly saying it wants to “run” an OPEC-adjacent state, with all the legal and regional blowback that implies. You still have live wars in Europe and the Middle East, plus unresolved Red Sea and shipping tensions affecting trade costs and supply chains.

Yet oil is only grinding higher from depressed levels, gold is already extremely extended, and the dollar is merely trying to base. Markets are saying, “Yes, the world is messy – but not messy enough to reprice everything at once.”

That gap between headlines and pricing is where FX traders either print a year, or blow one.

The question is not whether Venezuela or the next strike moves your favourite pair by fifty pips. The question is whether you have a clear framework for how this kind of world feeds into:

- Your structural dollar bias – are you short USD simply because last year rewarded it?

- Your use of gold and oil as macro signals – or are they just extra charts you glance at?

- Your overall risk – how much of your personal wealth now depends on being right about geopolitics?

This is where I can actually help.

We take what you already do – your pairs, size and style – and line it up with the world you are trading. Wars, oil shocks, political stunts. All the noise that moves FX and metals when you least expect it.

Then we get the basics right:

- Make sure you are trading on solid, sensible platforms with tight pricing and proper regulation.

- Use rebates and better terms where they genuinely improve your edge, not just to encourage more volume.

- Set risk limits that survive gaps and weekend headlines, not just tidy intraday moves.

- Decide how and when profits leave the trading account and become part of your longer-term wealth.

No drama. No miracle system. Just making sure your setup, your broker choice and your risk rules match the world you are trading.

In a world where one headline can move oil, gold and the dollar together, what do you actually want your FX account to achieve by the end of 2026?

Leave a comment