- Why the “Santa rally” is really about year-end flows and thin liquidity.

- How big money manages risk into Christmas across gold, Nasdaq and the dollar.

- What private traders can copy from institutional desks – and where Kyriwealth fits in.

Everyone obsesses over the Santa rally. Professionals obsess over balance sheets, liquidity and how portfolios look on 31 December.

With gold near record highs, the Nasdaq still elevated and the dollar soft, year-end flows matter more than festive stories.

Macro: Bostic, cuts and credibility

Atlanta Fed president Raphael Bostic has just fired a warning at markets celebrating lower rates. He argues that further cuts from here risk pushing policy back into clearly accommodative territory, reigniting inflation and damaging the Fed’s credibility.

That message lands into a year where inflation progress has stalled and markets have already priced a friendly 2026. In other words, policy makers want optionality. Traders want certainty. The result is a December tape that looks calm on the surface but hides deep disagreement underneath.

Against that backdrop, gold is holding near record highs, the Nasdaq sits just above 25,000, and the dollar index hovers around 98. Thin liquidity will decide who blinks first.

Levels: gold, dollar, Nasdaq

Gold (XAUUSD) – grinding at the top

- Gold trades around $4,300 after testing the $4,340 area again. Bulls still control the longer trend.

- $4,280–4,300 is first support. A break would say position reduction, not a change in the macro story.

- Above $4,340, forced buying can appear quickly as dealers hedge and trend systems re-engage in thin books.

- Into Christmas, institutional desks tend to trim leverage and roll hedges rather than open brand-new gold risk.

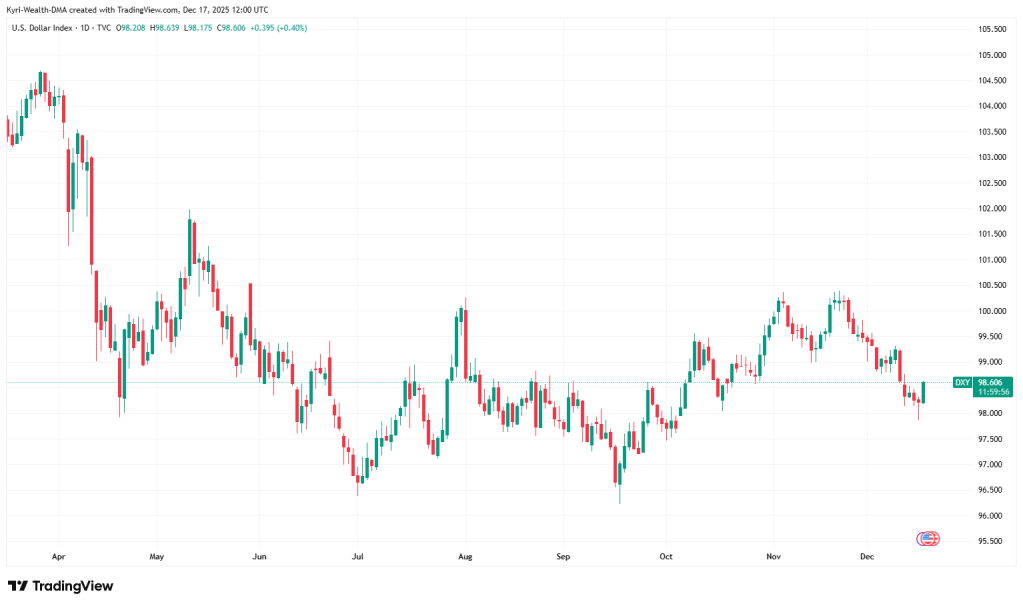

DXY – tired dollar, dangerous squeezes

The dollar index sits near 98.5 after a poor year and a recent bounce from the 98 handle.

- 98.0–98.2 is where real-money hedging interest usually appears, especially from exporters and global asset managers.

- 99.5–100.0 is the danger zone for crowded shorts. One hawkish comment or risk wobble can trigger a sharp squeeze.

- Big money scales limit orders rather than chasing every dip, letting illiquid December markets come to them.

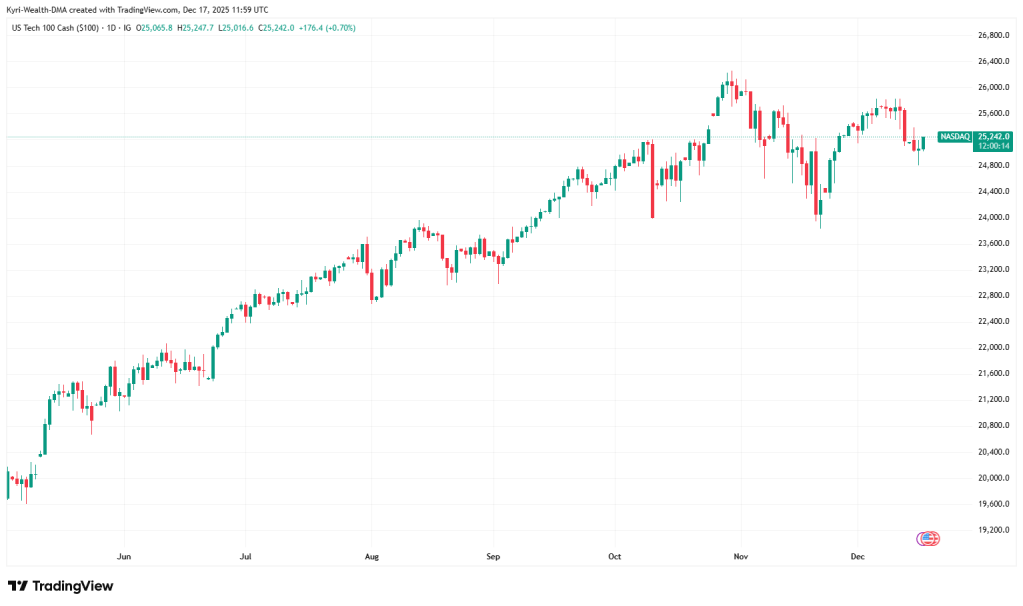

Nasdaq-100 – optics over bravery

- The Nasdaq-100 trades around 25,200 after pulling back from highs near 26,400 earlier in the quarter.

- 24,700–25,000 is the cosmetic line for many funds. Finishing above it keeps performance letters comfortable.

- 25,500–26,000 is where any late Santa squeeze flatters bonus pools more than it reflects genuine new information.

- Institutional desks are more likely to cut laggards and nurse winners than to launch fresh high-beta exposure now.

Human Truth

Big money loves thin Christmas markets; small money loves the story that Santa, not positioning, drives returns for most people.

Calendar: what actually matters this week

- Bank of England meeting – guidance on the pace of future cuts will drive sterling and UK rate expectations.

- European Central Bank decision – any pushback against market pricing for faster easing could jolt euro and Bund volatility.

- US core PCE and growth data – the Fed’s preferred inflation gauge will test whether markets or Bostic have the story right.

Wrap + CTA: Santa stories versus year-end reality

Here is the reality of December: professional desks usually do less, not more.

By mid-month, most large funds have effectively locked in the year. Risk committees want flatter books, not braver calls. Liquidity providers show smaller size, dealers tighten limits, and proprietary risk is clipped unless there is a very specific catalyst.

If you run your own account, this is when you either protect the year or quietly hand it back.

That is why you see a strange combination of sleepy sessions and sudden spikes. Markets run on automatic flows: index rebalancing, pension adjustments, tax-loss selling and portfolio window dressing, all layered over a retail belief in the Santa rally. None of those flows care about your favourite intraday level.

The Santa rally itself is more behaviour than magic. With fewer large sellers and steady passive inflows, prices often drift higher into year-end. In thin markets, modest buying can push indices further than normal. The risk is that traders mistake that drift for a fresh macro signal.

Thin liquidity is the key ingredient. There are fewer orders resting in the book and wider gaps between prices. A trade that normally moves a market ten points can move it thirty. A single unexpected headline can knock gold through support or squeeze the Nasdaq into new highs, simply because there is not enough depth on the other side.

So what do institutional desks actually do with their funds at Christmas?

They close risk that still needs constant watching. Positions that demand their attention are more likely to be reduced than doubled. They manage optics. Underperformers are trimmed so they do not dominate the year-end holdings list, while core winners are held or gently increased to signal conviction. They respect liquidity by slicing orders, slowing algorithms and crossing larger tickets away from the screen. Finally, they plan January rather than forcing December. The real decisions wait for full liquidity and full teams.

At Kyriwealth we treat December in the same way. We tighten risk with clients, map the key January scenarios, and help align portfolios with genuine flows instead of seasonal stories. If you want a second set of eyes on how your positions might behave in thin markets, that is precisely the work we do every day.

The myth says Santa delivers the rally. The reality is that positioning, flows and liquidity deliver your result. The question is whether that result is deliberate or accidental.

How are you set up into the final stretch of the year – chasing Santa, or managing risk like a pro?

You must be logged in to post a comment.