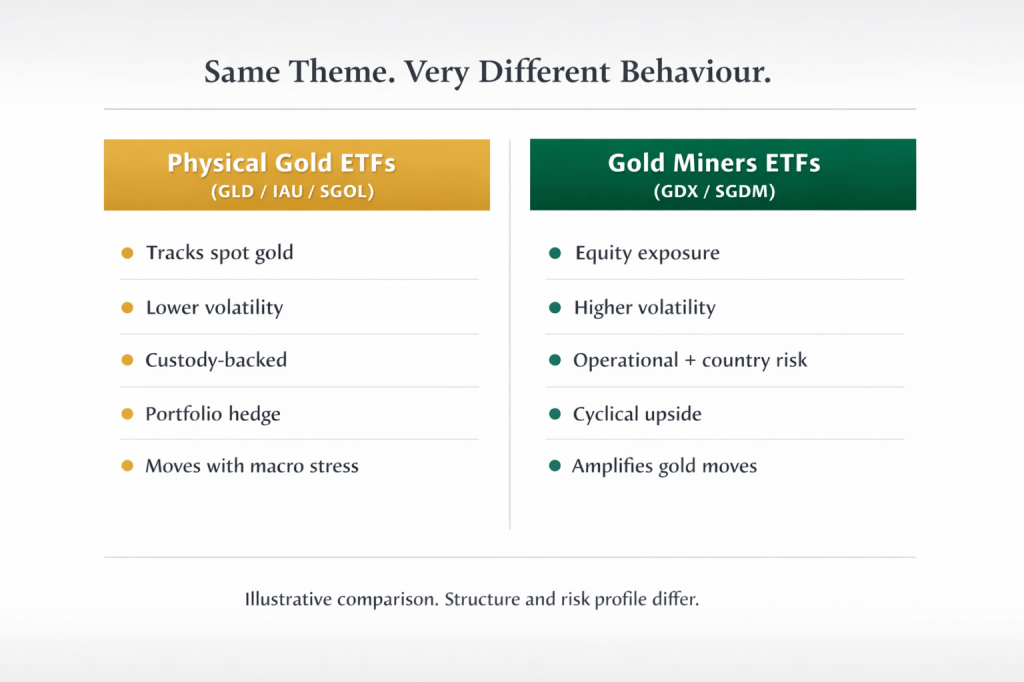

Gold had a strong 2025, but “gold ETFs” did not all behave the same.

- Physical gold ETFs delivered steady returns broadly in line with the gold price.

- Gold miner ETFs materially outperformed, with far higher volatility.

- Same theme, very different behaviour.

- Looking into 2026, institutions still view gold as relevant, but outcomes depend on macro conditions, not momentum.

The full picture

Gold didn’t have one year in 2025.

It had two very different ones.

On the surface, gold exposure looked straightforward. In reality, returns depended entirely on how that exposure was taken.

1. Physical gold ETFs, doing exactly what they’re meant to do

The main physical gold ETFs:

- GLD

- IAU

- SGOL

All three track spot gold closely. Differences sit mainly in fees, custody arrangements, and listing venues, not behaviour.

2025 YTD performance

- Physical gold ETFs delivered approximately +55–60%, broadly in line with the gold price itself.

They provided:

- transparent exposure,

- daily liquidity,

- custody-backed holdings,

- no operational or company-specific risk.

As one US investment bank noted this year:

“Gold’s value is less about timing returns and more about protecting portfolios when macro assumptions fail.”

That framing explains why physical gold stayed on institutional balance sheets throughout the year.

2. Gold miner ETFs, leverage without leverage

The main miner ETFs discussed:

- GDX

- SGDM

These are not proxies for gold.

They are equity portfolios whose revenues happen to be linked to gold prices.

2025 YTD performance

- GDX delivered approximately +120–150%.

- SGDM delivered approximately +100–130%.

The drivers were clear:

- higher gold prices expanded margins,

- costs did not rise one-for-one,

- equity markets re-rated miners aggressively.

But the risk profile is fundamentally different:

- equity drawdowns,

- management execution risk,

- geopolitical exposure,

- energy and labour cost sensitivity.

As a European asset manager put it earlier this year:

“Gold miners amplify the cycle. They reward conviction, but they punish complacency.”

2025 was a textbook example.

3. One comparison that matters

A simple, equal-weight average across the five ETFs would show a 2025 return of roughly +80–90%.

That headline number is misleading.

The real lesson is simpler:

- physical gold behaved like a hedge,

- miners behaved like high-beta equities.

Same theme. Different tools. Different outcomes.

4. What actually matters for 2026

No serious institution is forecasting straight-line gains into 2026.

What they are watching instead:

- central bank gold demand,

- real interest rates,

- currency volatility,

- geopolitical risk,

- ETF inflows versus equity risk appetite.

Recent institutional commentary has been consistent on one point:

“Gold remains relevant in an environment where policy certainty is low and balance sheet protection matters.”

Translated:

- physical gold remains a portfolio decision,

- miners remain a cyclical equity decision.

If those macro drivers shift, behaviour will change.

5. The grown-up takeaway

- Physical gold ETFs are about exposure and protection.

- Gold miner ETFs are about upside and volatility.

- Neither behaves like CFDs.

- Neither requires leverage to be effective.

This isn’t about gambling.

It’s about choosing the right structure for the role gold plays in a portfolio.

Access, not advice

If you’re looking to access gold ETFs or broader multi-asset markets with proper custody and institutional-grade infrastructure, I support onboarding via EXANTE, a regulated global prime broker.

Registration or demo access is available here:

https://exante.eu/p/39557/fromkky/

Market commentary only. Not investment advice.

You must be logged in to post a comment.