A divided Fed, a softer dollar, and why chasing moves today is a bad hobby.

The Fed gave you the expected 25bp cut… and a very unexpected amount of drama.

Behind Powell’s calm press-conference voice, the central bank is split three ways:

- some wanted no cut,

- one wanted a bigger cut,

- and a chunk of regional presidents quietly signalled they’d rather have left rates alone.

Add in missing data from the government shutdown and the fact Powell’s chair is up for grabs next year, and you’ve got what I’d call: policy made in partial darkness, by a committee that doesn’t fully agree with itself.

So what do we actually trade off that?

1. The Fed: Cut now, argue later

Official line: rates down to 3.50–3.75%, and the “base case” isn’t a hike from here.

But the dot plot tells a different story. Policymakers only see one more cut next year, while markets still fancy a bit more easing into 2026.

Key message for us:

The Fed has moved from “higher for longer” to “we’ll see” – and they’re as unsure as everyone else.

In a data-light environment, guidance is weaker and swings in sentiment matter more than the dots.

2. Market reaction – what your charts are really saying

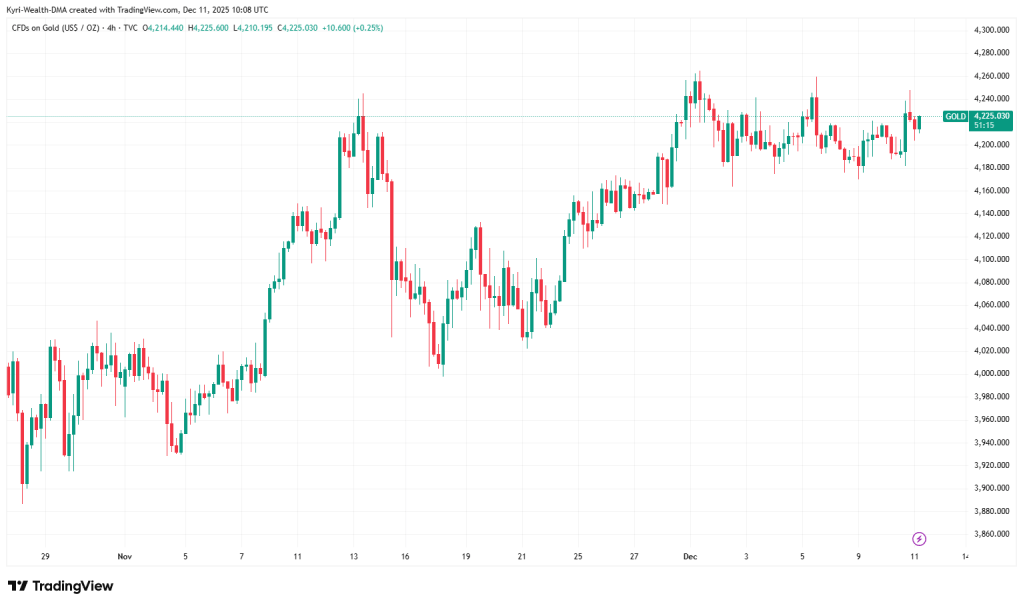

Gold (4H)

Gold’s holding firm after the decision, edging higher as the dollar softens and the market prices a slightly easier Fed path.

- The structure still favours buying dips over chasing spikes, while price sits closer to the upper end of the recent range.

- Watch how it behaves if we retest the prior breakout zone – that’s where real conviction shows up, not at the extremes.

Dollar Index – DXY (4H)

DXY sold off into the meeting and tried to stabilise on classic risk-off: weak equities, softer crypto, shaky sentiment.

- This is not a clean “new dollar trend” yet – it’s positioning being reset after traders bet on a hawkish cut and didn’t get it.

- Today is about whether the dollar can base out here or whether rallies keep getting sold.

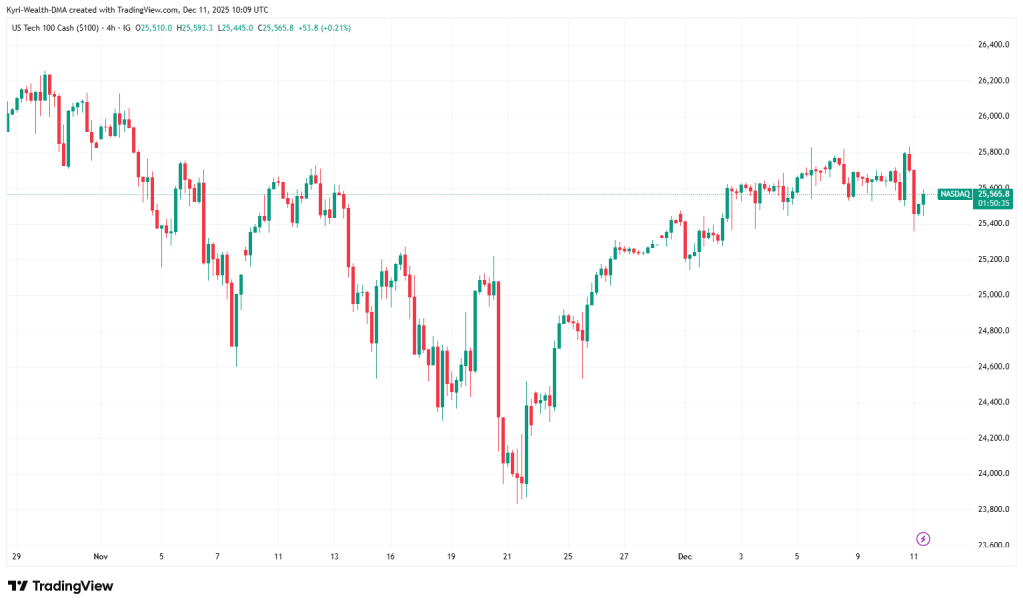

US Tech 100 / NASDAQ Cash (4H)

Tech remains near the upper third of its recent range but is clearly more fragile.

- AI names wobbling and a slightly less hawkish Fed is a weird mix: easier policy should help, but if earnings can’t keep up with the story, dips get deeper.

- For now, buyers still show up on weakness, but they’re not chasing highs with the same enthusiasm.

3. What matters for you today

Your followers don’t need another “FOMC recap”. They need a lens:

- The Fed is divided and flying on old data.

Expect more noise around each print as the data calendar normalises. - The dollar is softer, not broken.

If risk stays heavy, the greenback can still find support – this isn’t a one-way trade. - Gold and Nasdaq are still the barometers.

- Gold holding firm tells you the market still worries about inflation and policy error.

- Nasdaq holding up tells you growth fears aren’t front and centre… yet.

This is a time to respect ranges, not fall in love with narratives.

4. How I’m framing it for the day

- I’m less interested in what Powell said and more in where price respects or rejects the last 24h extremes on Gold, DXY and US Tech.

- Big lesson here: you don’t have to predict the next Fed move to trade well – you just need to know where the market is wrong-footed.

This email is for information and education only and is not investment advice or a recommendation to buy or sell any instrument. Markets can move quickly and you remain responsible for your own trading decisions and risk management.

You must be logged in to post a comment.