Markets are marking time into tomorrow’s Fed cut, with equities slightly softer, gold still elevated and the dollar drifting. The real risk now is not the rate move, but how Powell and the dot plot reset expectations for 2026.

For traders, today is about keeping powder dry and knowing exactly where you act around gold, DXY and the Nasdaq.

Macro

Equities slipped overnight as the S&P 500 gave back -0.35%, with 10 of 11 sectors down, while US 10-year yields nudged up to around 4.17% and the dollar index edged higher near 99.1 into “almost-Fed” day.

Positioning is now about how hawkish tomorrow’s guidance sounds, not the widely expected 25 bp cut, with bond desks clearly betting on a shallow easing path and only modest labour weakness.

Streaming Wars: is IP the only anchor?

The corporate soap opera is back in streaming, and it actually matters for investors’ risk appetite.

Paramount Skydance has lobbed a hostile $77.9bn all-cash bid at Warner Bros. Discovery, offering $30 per share and going straight to shareholders. Netflix is already on the scene with a $72bn agreed deal dependent on Warner carving out its studios and HBO Max streaming unit from its legacy cable networks. Warner’s board still backs the Netflix structure, arguing that once you include continued ownership of the cable assets, the value is closer to $31–32 per share.

The mechanics are dull but the message is not: in mature streaming, scale and premium IP libraries are now the only real bargaining chips. Whoever ends up with Warner’s catalogue and brands wins leverage over both subscribers and advertisers. Shareholders have until early January to decide whether they want certainty (Paramount cash) or a more complex mix of Netflix equity and a rump cable business that could either be milked or slowly run off.

There are three investor read-throughs:

- IP is collateral, not a growth story on its own. Libraries now get valued on their ability to support pricing power and ad loads, not on blue-sky subscriber projections. That caps the sort of multiples the market is willing to pay for “content plays” without a clear distribution edge.

- Balance sheets matter again. Paramount can credibly launch a hostile bid because financing is still available and rates, while higher than 2020, are no longer choking M&A. But if tomorrow’s Fed message points to a shallower cutting cycle, you should assume the cost of capital floor has shifted higher for good.

- Equity indices can rally while leadership narrows. Yesterday, Information Technology was the S&P 500’s best sector, up nearly 1%, driven by Micron, ON Semiconductor and Broadcom, while Communication Services – including Netflix – lagged badly. The AI-hardware trade is still doing the heavy lifting; old “growth” sectors without a clean AI angle are being used as funding.

Bottom line for trading: don’t confuse headline drama with trend. The streaming battle might move single names and keep volatility bid in Communication Services, but for our purposes today the axis is still simple – Fed path vs. labour data vs. dollar and yields.

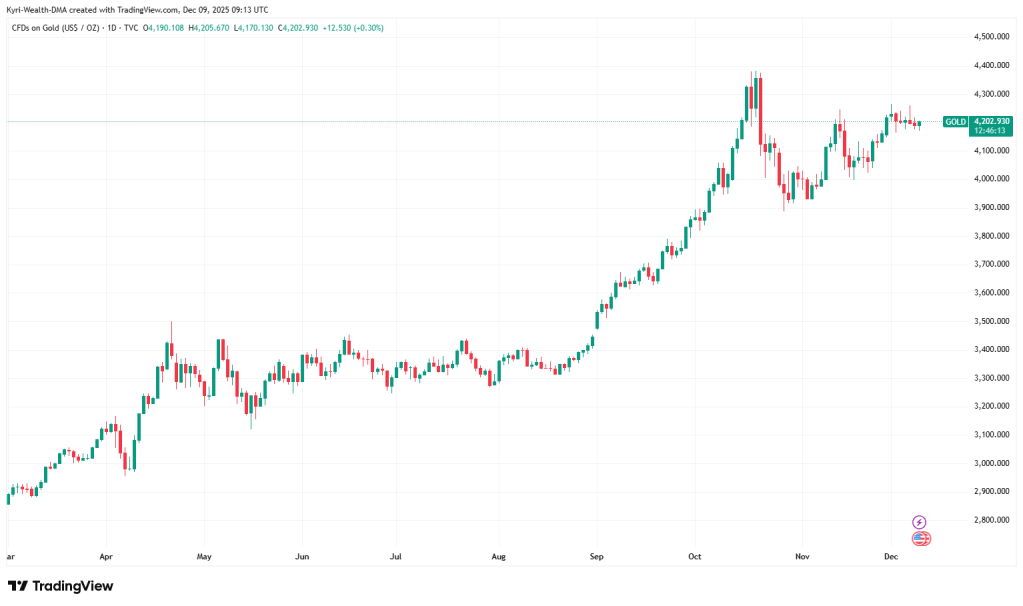

Gold: still in an uptrend, but running hot

Gold dipped -0.17% to around $4,189.59 yesterday but remains close to early-December highs above $4,260 and comfortably above its August–December uptrend line near $4,075.IG+1 Prices are consolidating rather than reversing, which fits with a market that expects a cautious Fed cut rather than a full pivot.

Technically, gold is range-trading just under resistance around $4,265. A decisive break and daily close above this zone would open the door to the $4,300–4,308 extension cluster mentioned in recent technical notes.IG On the downside, any Fed-driven spike in real yields or a knee-jerk pop in DXY could see a squeeze lower towards that $4,075 trendline without breaking the broader bull structure.

For London-session traders, this is a levels game, not a macro guessing contest. The aim is to know in advance where you are prepared to fade a Fed-relief spike or buy a clean flush.

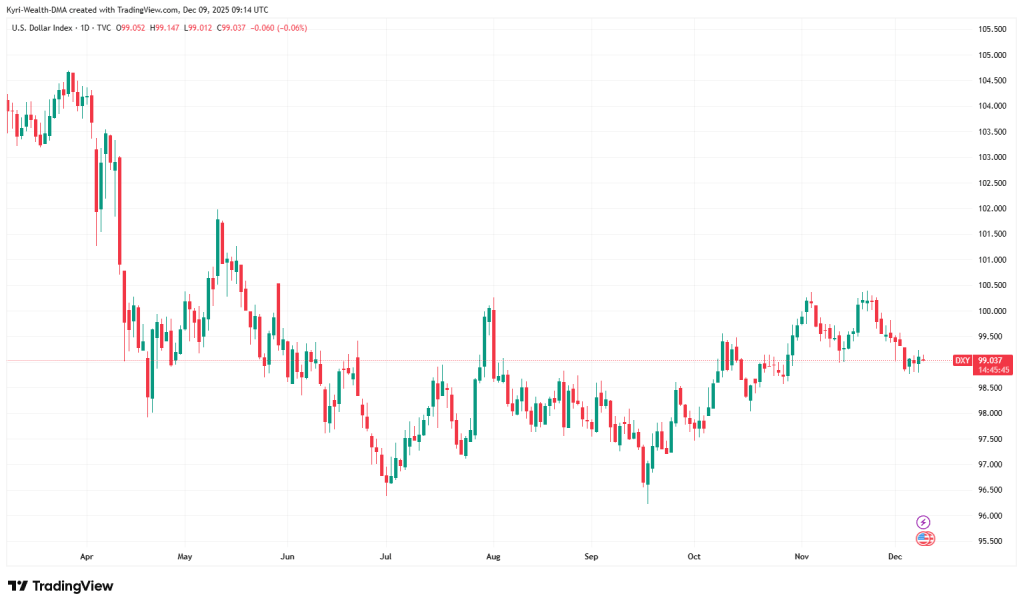

DXY: soft up-drift into the Fed

The dollar index sits just under 99.1, slightly firmer on the day but still well below its November highs, with price carving out a messy range between roughly 98.5 and 100. Yields are not exploding higher; instead, there is a cautious rotation out of the very long end of the US curve into intermediate maturities ahead of tomorrow’s decision.FT Markets+1

What matters today is how the labour data lands versus expectations. A softer-than-feared JOLTS or ADP print will make it harder for Powell to sound convincingly hawkish tomorrow, which caps upside for DXY and keeps the door open for a renewed drift lower into year-end. A beat, particularly on openings, gives the Fed cover to talk tough about the “bar for the next cut”, which would support the dollar and pressure metals and tech.

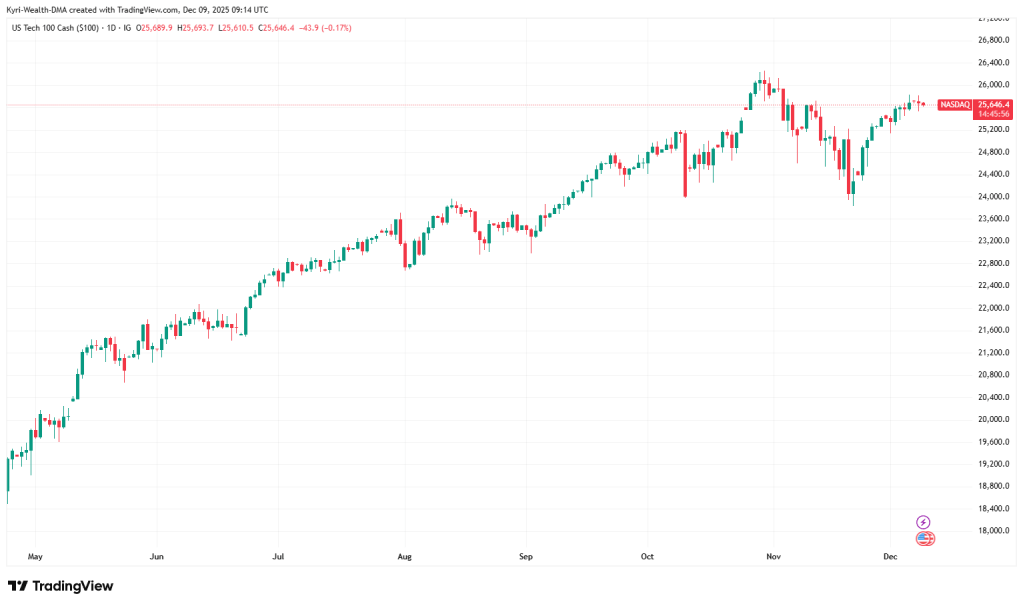

Nasdaq 100: cooling, not cracking

The Nasdaq 100 slipped about -0.25% yesterday after a run at the highs, with the broader Nasdaq Composite off only -0.14% as mega-cap tech stayed mixed – Microsoft and Nvidia up, Alphabet, Amazon and Tesla lower. The structure on the daily chart still looks like a grind higher with shallow pullbacks rather than a topping pattern.

The key question for today is how much “AI easing” is already in the price. The market has largely priced two more cuts after December through the end of 2026. If the dot plot confirms that, upside from here is limited without a fresh earnings narrative. If the Fed signals fewer cuts, you should expect a sharper reaction in high-duration tech than in the broader S&P.

Levels – Gold, DXY, Nasdaq 100

These are reference zones for the London session; adapt them to your own system and risk.

- Gold (spot/CFD)

- Immediate support: 4,180–4,190

- Deeper support: 4,130, then trendline / swing area around 4,075

- First resistance: 4,250–4,265 (recent high band)

- Extension targets on break: 4,300 then 4,308

- DXY

- Support: 98.50, then 98.00

- Resistance: 99.60–99.80; bigger line in the sand around 100.50

- Bias: mildly bid into Fed, but vulnerable to any dovish surprise in dots or press conference

- Nasdaq 100 cash

- Last area: ~25,650

- Support: 25,200, then 24,800 (where the last sharp dip was bought)

- Resistance: 26,000 psychological, then 26,400 recent swing high

- Bias: still constructive while above 25,200, but extremely sensitive to any shift in Fed path or AI earnings guidance

Calendar – London focus (today)

(All times approximate, London time; check your own platform/calendar before trading.)

- 08:00 – Germany Trade Balance; 09:00 – Bundesbank President Nagel speaks (EUR)Forex Factory

- 10:00 – BoJ Governor Ueda speech (JPY) – spill-over for global yields and risk appetiteForex Factory

- 16:00 – US JOLTS Job Openings (Sep, delayed) and related labour data; key input into tomorrow’s Fed decisionForex Factory+1

Keep an eye on any unscheduled Fed commentary or leaks ahead of the decision – liquidity can thin quickly the day before.

Human Truth

Everyone says they are “waiting for the Fed”, but real pros are already clear on what they will do if the market reacts the opposite way to their base case.

You must be logged in to post a comment.