Summary

This week is simple but not easy. Gold is trending like an adult, Nasdaq is grinding higher on hope, the dollar is bleeding lower, and oil has quietly put geopolitics back on the table. With an expected Fed rate cut and a crowded central-bank calendar, the real edge isn’t guessing the headline – it’s understanding your risk, your levels, and where you’re actually willing to be wrong. Here’s what I’m looking at as Asia clocks off and Europe/UK comes in.

Macro – what the market is really pricing

Asia has handed Europe a calm, almost boring finish – but the tape underneath isn’t boring at all.

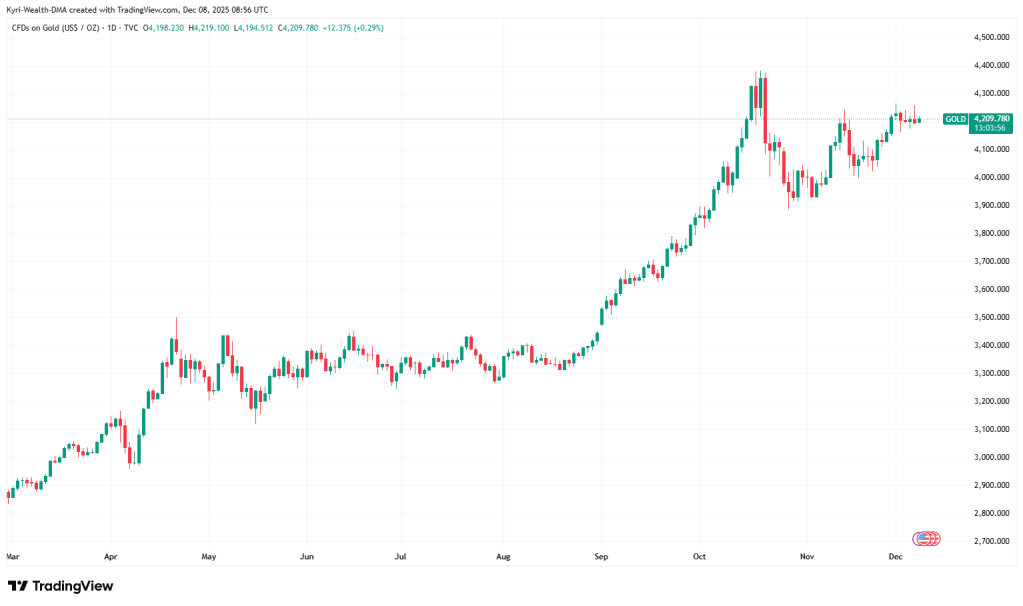

Gold sits near the top of a very clean, months-long uptrend. This is not a meme spike or a one-day wonder – it’s the result of the market quietly admitting that real yields are rolling over and that we are moving into an easing phase, whether central bankers enjoy saying it out loud or not. Every wobble has been bought, and the latest consolidation near 4,200 is just the market catching its breath.

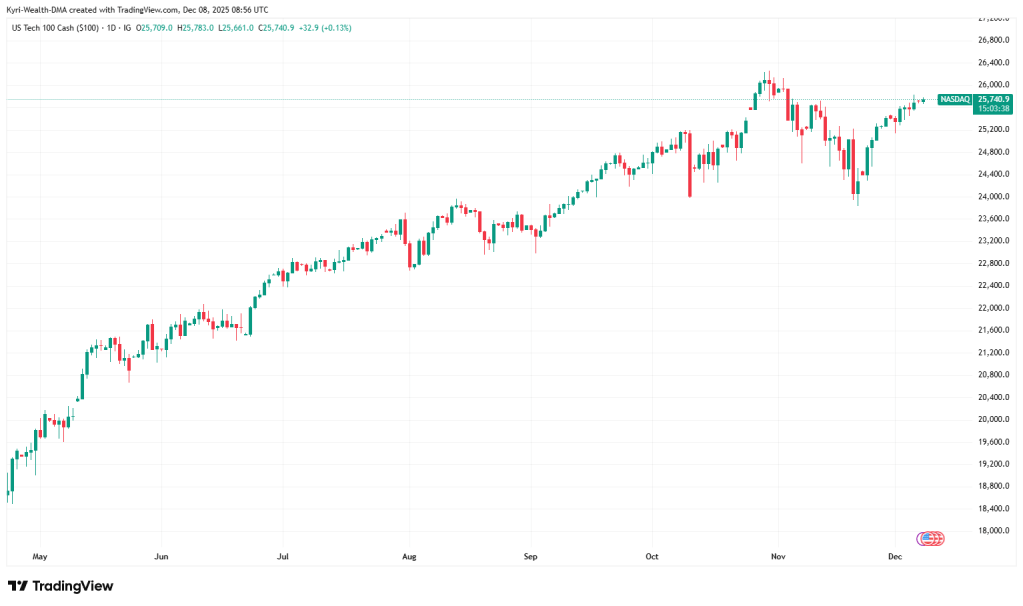

Nasdaq tells a related story but with a bit more drama. We’re not in melt-up mode; we’re in grind mode. The index keeps walking higher, shrugging off dips, living off the promise of cheaper money and “okay-ish” growth. Late-cycle optimism, basically. That’s nice until the narrative changes. One hawkish surprise from the Fed or a growth scare, and that steady staircase higher suddenly matters a lot less than the gap underneath.

Then we’ve got the dollar, sliding away in the background. DXY has been leaking lower and now sits just under the 99 area. Not a collapse, but a controlled drip. That weaker dollar is what’s feeding both the gold strength and the tech resilience. As long as the greenback stays on the back foot, risk assets look clever and hedges feel expensive. The danger is the classic post-event snap-back: dovish expectations into the meeting, mild disappointment during the press conference, and suddenly DXY is ripping higher while everyone else is the wrong way round.

Add oil to this cocktail. Crude is hovering near two-week highs, supported by the expectation of a Fed cut and a mix of Russian and Venezuelan supply risk. It’s not full-blown panic, but it’s a reminder that inflation isn’t dead just because everyone is bored of talking about it. If oil stays bid into and after the Fed, any “we’re cutting because inflation is done” story will age badly.

Put together: gold up, Nasdaq firm, DXY soft, oil nudging higher – that’s the market pricing in a clean easing story with just enough geopolitical spice to keep hedges alive. My job this week is not to believe or disbelieve that story. It’s to know exactly where it breaks.

Levels – where I care today

- Gold:

- Key zone: 4,180–4,230. We’ve broken out, we’re consolidating, and pullbacks so far have been shallow.

- While price holds above recent swing support, bias stays long. I’m far more interested in buying controlled dips than gambling on a top. Serious damage only starts if we lose that last higher low with momentum.

- Nasdaq 100:

- Focus area: 25,600–25,900. This is the grind zone – not a blow-off, not a crash, just persistent demand.

- I don’t want to be the clown chasing the breakout the day before the Fed. Far better to let the event hit, then see whether we’re buying a clean pullback or fading a silly spike.

- DXY (US Dollar Index):

- Battle zone: 98.50–99.20. This has gone from prior support to a messy fight.

- As long as DXY struggles to get back above the top of that band, the path of least resistance for gold and risk assets stays up. A sharp reclaim and close above it after the Fed would be my first big warning sign that the party is over.

The short version: long gold with discipline, cautious on chasing Nasdaq, very alert to any dollar squeeze, and treating oil as the quiet troublemaker in the background.

Human Truth

Most traders pretend they have conviction; what they actually have is a fear of missing out and a Twitter feed. The edge this week is being boring enough to wait for your levels, not their headlines.

Calendar – where this can go wrong

I don’t care about every data print; I care about the ones that can change narrative and positioning:

- Tuesday – RBA / BoJ / US labour flavour

Australia’s cash rate and the RBA statement set the tone for “how brave are central banks really?”, while earlier and later labour-market and JOLTS data shape how relaxed the Fed can sound about employment. - Wednesday – Fed day (the main event)

Federal funds rate decision, statement, economic projections and the press conference. This is where the market finds out whether we’re getting a clean cut with a friendly tone, or a messy “we’re cutting but don’t get excited” message. Expect the real move not on the number, but in the Q&A. - Thursday / Friday – the follow-through (SNB, BoE, UK data)

SNB and BoE decisions and speeches, then UK GDP and jobless claims on Friday. These tell us whether the easing story is global or still US-centric, and whether sterling and UK assets can afford to ignore the rest of the world’s stress.

If you trade this week like every day is equal, you’re already behind. The game is to scale risk around these clusters, not pretend it’s all just another Tuesday.

You must be logged in to post a comment.