US futures come into the cash open firm, with the S&P sitting near the highs, the dollar still heavy and gold holding bid. The charts are clear: the market is still trading a “Fed can cut without losing the inflation fight” story.

That gets tested at 10:00 ET / 15:00 UK with the first PCE print since the shutdown. It’s a big Friday: not about guessing the number, but about seeing whether the data confirms the current sentiment on your S&P, DXY and gold charts or forces a reset into the weekend.

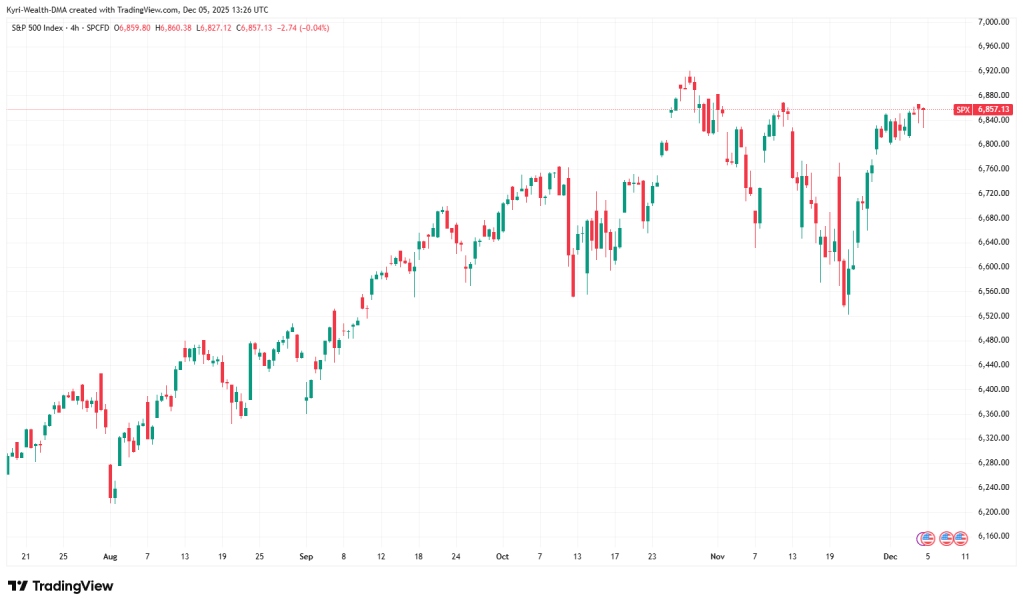

S&P 500 at 6,880 – This Session in One Glance

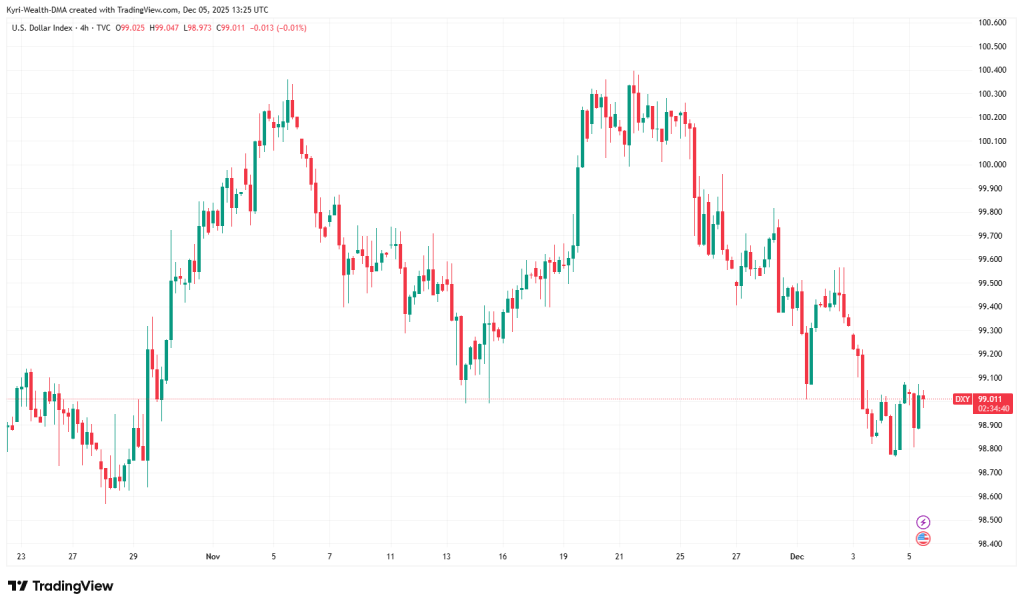

- Setup: S&P futures near 6,880, with the index a step below record highs, DXY around 99 and gold sitting in the 4,200s – classic “cut and carry on” positioning.

- Catalyst: 10:00 ET / 15:00 UK / 17:00 Cyprus – first PCE inflation print since the 43-day shutdown; this is the only number that really matters today.

- If PCE is soft / in line: Buy S&P dips above 6,820, keep a bullish bias on gold, fade DXY rallies while it’s below 99.60.

- If PCE is hot: Fade S&P spikes into 6,900–6,950, look for a dollar squeeze towards 100, and expect gold to test 4,180–4,150.

1. Where we are now

The tape into the US open is calm but loaded with expectations.

- Equities: December E-mini S&P futures are holding around 6,880 after a week of grinding higher and closing Thursday near the highs.

- Dollar: DXY is sitting just under 99 after slipping from the 99.5–100 area over the last two weeks – weak, but not collapsing.

- Gold: Spot gold is holding around 4,200, with the last few sessions locked in a relatively tight range.

In other words: risk is still priced for a friendly Fed and contained inflation. Today’s PCE either rubber-stamps that or forces a rethink.

2. What the big money is pricing in

Futures and options are already telling the story:

- The market is pricing roughly an 85–90% chance of a cut at the next Fed meeting.

- The recent move lower in DXY and grind higher in US indices reflect that – they’re trading the path, not the single print.

- Small caps and rate-sensitive names have started to outperform, classic behaviour when the street leans into “cuts are coming and they’re safe.”

For you, the key point is this:

PCE doesn’t need to be amazing – it just needs to not scare the Fed.

As long as core PCE comes in somewhere close to the expected 2.8% y/y and 0.3% m/m, the default setting is:

- Dips in S&P are bought.

- Dollar bounces are sold.

- Gold is held as quiet insurance.

Anything that looks like a trend higher in inflation – not just one noisy monthly blip – is what can break that story.

3. Geopolitics and narrative noise

Today’s narrative is unusually clean:

- The 43-day shutdown froze official data; this is the first proper read since.

- Inside the Fed, you’ve got a split:

- One camp worried about sticky inflation, driven by tariffs and fiscal policy.

- Another camp more focused on signs of slower real activity.

Geopolitics, elections and energy headlines are still there in the background, but they are secondary to the rate path.

For S&P, DXY and gold:

- Random headlines can spike a 5–15 minute move.

- Unless they shift the expected path of policy or real yields, those spikes usually fade behind whatever PCE does to the curve.

4. Today’s event risk (times in UK)

Into and after the open:

- 15:00 UK – US PCE cluster

- Core PCE (Fed’s preferred inflation gauge)

- Personal income and spending

- Consumer confidence / expectations

This is the first big macro data release since the shutdown and the last major input before the Fed meeting.

- Late US session

Positioning into next week’s decision takes over – options flows, gamma, and end-of-week rebalancing can all amplify whatever PCE does to the main trend.

If you strip it all back, the day boils down to:

“What does PCE do to the odds and timing of further cuts?”

5. The actual trade map: levels and correlations

My key zones for today

- S&P 500 futures (Dec)

- Support: 6,820, then 6,750

- Resistance: 6,900, then 6,950

- DXY

- Support: 98.80

- Resistance: 99.60, then 100.00

- Gold (XAUUSD)

- Support: 4,180, then 4,150

- Resistance: 4,240–4,265, then 4,300

While we hold above support

As long as:

- S&P stays above 6,820,

- DXY stays below 99.60, and

- gold holds above 4,180,

the market is basically saying:

“The Fed cut story is intact; PCE didn’t break anything.”

In that environment:

- S&P: Treat dips into 6,820–6,850 as opportunities to join the trend rather than panic.

- DXY: Use bounces towards 99.60 as areas to fade the dollar, especially if yields aren’t breaking higher.

- Gold: Dips into 4,180–4,200 remain zones to reload quiet long exposure.

You’re not chasing; you’re letting the data confirm the existing regime and then trading back into it.

Into resistance – where you don’t chase

If PCE comes in soft or in line and we break towards:

- S&P 6,900–6,950,

- DXY 98.80–98.70 lows,

- gold 4,265–4,300,

you want to slow down and watch the texture.

- If S&P is screaming higher but the dollar and yields are flat, that’s more likely positioning and FOMO than a clean macro breakout.

- If S&P breaks 6,900 with DXY making fresh lows and gold holding firm, that is a stronger confirmation of the “cut and carry on” story.

Either way, the first spike after the number is for the machines. Your edge is waiting to see which side holds and then leaning into the retest.

When it becomes an unwind, not a dip

There’s a line where this stops being a pause and turns into an unwind.

For me today, that looks like:

- S&P closing below 6,750,

- DXY breaking and holding above 100,

- gold losing 4,150 and failing to bounce.

That combination says:

“The market has started to question the safety of more cuts.”

In that case, you stop treating every dip as a buy, cut risk, and re-map the trend rather than fighting it.

If you’re reading this after PCE

Most people will read this after the release, not before. That doesn’t kill the edge; it changes the question.

Instead of “what will happen?”, ask:

- Which path did the market choose?

- Soft / in line path → S&P above 6,820, DXY below 99.60, gold holding 4,180+.

- Hot path → S&P rejected from 6,900, DXY pushing towards 100, gold leaning on 4,150.

Once you know which map you’re on, your job is simple: trade the pullbacks in that direction, not the noise against it.

6. How I’m using this, and how to follow along

I use this framework every US session to decide one thing:

Am I buying dips, fading spikes, or staying flat until the picture clears?

Today that means:

- Respecting the pre-open structure (strong equities, soft dollar, supported gold).

- Letting PCE hit at 15:00 UK

- Trading the reaction versus these levels, not trying to be the hero who guesses the exact print.

If you want this same structure every day – S&P, DXY and gold levels, event times in UK, and a clear “soft / in line / hot” map – stay close to the blog and my Telegram updates.

I execute through Vantage for pricing and infrastructure.

None of this is advice; you are responsible for your own risk, size and timing.

You must be logged in to post a comment.