This morning in one glance

- Equities: S&P 500 is sitting just under the highs after yesterday’s small red day – futures in the US and Europe are a touch higher into the London open. Bloomberg+1

- Dollar: DXY is stuck around 99, close to a five-week low as markets lean heavily toward a Fed cut next week. Reuters+1

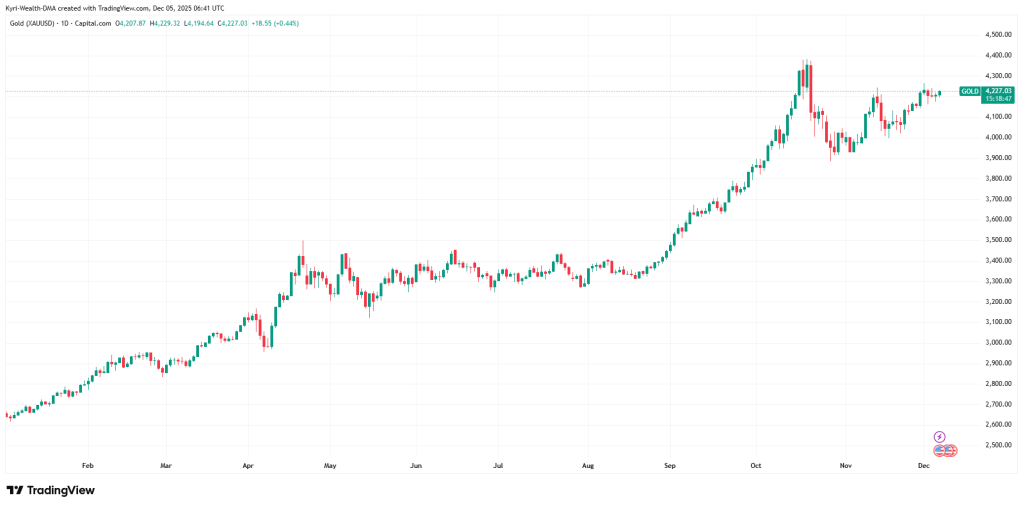

- Gold: Spot gold is holding around 4,200–4,250, slightly higher on the day and still behaving like quiet insurance while everyone waits for the US inflation print later. Reuters

The story is simple: the market is already trading the Fed cut. Today’s data either rubber-stamps that idea or gives the dollar a short-term lifeline.

1. Tape in 60 seconds

Asia was mixed overnight. Japan’s Nikkei gave back the week’s gains, down around 1.3 percent as investors price a Bank of Japan hike later this month. Outside Japan, the regional index is still up on the week. Reuters

Into Europe, US and Euro Stoxx futures are up about 0.2 percent, Nasdaq futures closer to 0.4 percent. It is a gentle risk-on tone rather than a squeeze. Bloomberg+1

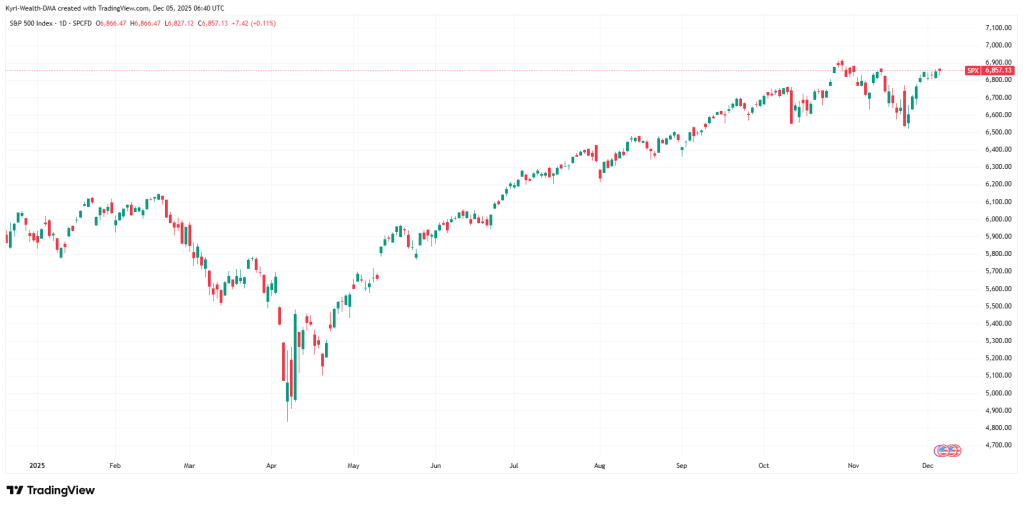

On your S&P daily chart, price is hovering just below 6,900 after a strong grind higher from the April lows. Yesterday’s candle was small and negative – more pause than reversal.

The dollar index has slipped to roughly 99, on course for another weak week as traders price an almost certain 25-basis-point cut from the Fed next Wednesday. Reuters+1

Gold is still well bid, trading in the low 4,200s after the autumn breakout. Reuters has spot up around 0.2 percent this morning, only a fraction off recent highs. Reuters

2. Today’s key times (UK)

From the calendar, all times are UK:

- 15:30 – Canada employment data

Employment change and unemployment rate. First volatility window for CAD and anything tied to risk sentiment out of North America. - 17:00 – US data cluster (the main event)

- Core PCE Price Index month-on-month – the Fed’s preferred inflation gauge.

- Personal income and spending.

- Preliminary University of Michigan consumer sentiment and inflation expectations. Reuters+1

Remember, there is no Non-Farm Payrolls release today. The previous report never printed because of the US government shutdown, so the Fed is relying even more on PCE and the broader inflation picture into next week’s decision. Reuters+1

3. What the market is really trading

The centre of gravity is the Fed:

- Futures put the odds of a quarter-point cut next week in the high eighties, according to FedWatch. Reuters

- The dollar index is near a five-week low as a result, and global equities are getting a tailwind. Reuters+2Reuters+2

That gives us a clean backdrop:

- If PCE prints in line or softer:

The “cut and carry on” narrative remains intact. Equities keep a bid, the dollar struggles to bounce, and gold stays comfortable above 4,200. - If PCE surprises on the hot side:

Yields push up, the dollar finally finds a floor, and anything at the top of the S&P range looks vulnerable to a fade rather than a breakout.

4. Trade map – S&P, gold, dollar

S&P 500

- Support: 6,800 then 6,700

- Resistance: 6,900 then 6,950

Above 6,800 the market still looks like an uptrend taking a breather. Dips into that band are corrections, not necessarily the top of the move. A soft or in-line PCE should see traders happy to buy dips rather than aggressively short new highs.

If we spike above 6,900 on a data knee-jerk and then fail quickly, that is the sort of move you frame as a fade back into the range. A proper break and close below 6,800 would be the first time in a while you can talk about de-risking rather than routine noise.

Gold

- Support: 4,150 then 4,050

- Resistance: 4,300 and recent highs

While the dollar is weak and cuts are priced, gold’s default play is to treat dips as opportunities. A gentle PCE print and softer dollar makes a retest of the 4,300 area very doable.

If PCE comes in hot and DXY squeezes, gold can easily be pushed back toward the 4,150 zone – which is where you watch whether real money steps back in, or whether positioning has become too crowded.

Dollar Index (DXY)

- Support: 98.5

- Resistance: 99.5 then 100

Below 99.5 the dollar remains under pressure. Each weak data point feeds the narrative that the Fed is behind the curve on cutting. That helps S&P and gold trade in the same direction.

Only a clear upside surprise in PCE gives DXY a shot at reclaiming 100 and flipping the tone back to “dollar first, everything else second.”

5. How I am using this, and how to follow along

I am using this map to decide one thing each day: am I fading extremes back into the range, joining the trend after confirmation, or staying flat because the picture is not worth the risk. Today that decision sits around 15:30 and 17:00 UK time, with S&P, gold and DXY doing the talking.

If you stay close, you will keep getting the same structure each morning – tape in a minute, the key times, and a clear trade map on S&P, gold and the dollar – so you are never guessing what actually matters when London and New York switch on.

I execute through Vantage for pricing and infrastructure. None of this is advice; you are responsible for your own risk and position size.

You must be logged in to post a comment.