Asia mixed, dollar catches its breath, metals still running hot

Today in one look

- Weak U.S. data has the market treating a Fed cut next week as almost a done deal.

- The dollar has been sliding for days and is only now trying to stabilise.

- Gold and silver have had a serious run – still supported, but no longer “cheap”.

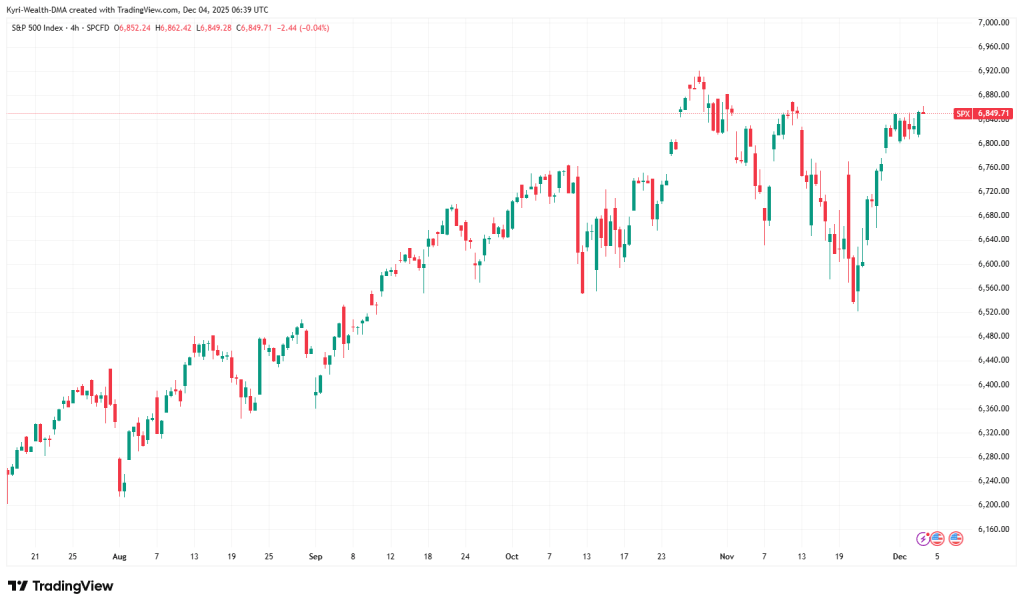

- U.S. indices are grinding near the top of the range while small caps finally wake up.

- Asia is split: Japan strong on chips, the rest of the region fairly flat.

1. Yesterday on the tape – what actually happened

U.S. data came in soft: private payrolls saw their biggest drop in a couple of years and services employment cooled. That was enough for the market to lean harder into a rate cut next week.

Equities liked it. Small caps led with a squeeze higher, the S&P 500 added another up day, and futures into Asia were steady rather than euphoric.

The dollar kept sliding, pushing to a five-week low after a long run of red days. That move helped drive gold and silver into another leg higher, with silver printing a fresh record before easing.

In Asia, the picture was mixed. Japan traded well – chip names in particular – while Korea and New Zealand faded and kept the regional index close to flat. Nothing dramatic, but enough to tell you risk appetite is still there, just selective.

2. Where we’re waking up today

This morning is less about new information and more about location:

- The rate-cut story is crowded – everyone can see the same probabilities.

- The dollar is stretched lower, and any proper bounce will test how committed people are to the “easy cuts” view.

- Metals are extended – the trend is up, but the entry quality is nowhere near what it was a week ago.

- Indices are closer to their highs than their lows, with volatility drifting down into the Fed.

This is classic pre-event price action: the market has moved ahead of the meeting and is now deciding whether to sit tight, add a bit more, or take some off.

3. Gold – momentum with altitude

Gold is holding in the 4,180–4,210 region after a strong, almost one-way climb. The structure is still constructive: higher lows, pullbacks getting bought, and dips in the dollar continuing to help.

The trade-off is clear:

- On the plus side, the backdrop of softer data, lower yields and a pressured dollar hasn’t changed.

- On the risk side, we’re now trading closer to resistance than to any obvious value area.

For most traders, today isn’t about inventing clever counter-trend ideas. It’s about deciding whether you’re managing an existing long sensibly, or whether you really need fresh exposure this close to the Fed when the market has already done a lot of the work.

4. Indices – S&P / NAS100 killing time into the Fed

The S&P 500 and Nasdaq 100 are both behaving like markets that want to stay strong but don’t want to make a big statement before Powell speaks.

- Pullbacks are shallow and bought.

- There’s no real panic in futures.

- Participation has broadened a little with small caps finally joining in.

The opportunity isn’t in guessing the exact top or bottom; it’s in recognising that the better entries tend to appear after the event, when the new narrative is clearer and positioning has been shaken out.

If you’re long, the question is whether your levels make sense if we get a standard “buy the rumour, wobble on the day” reaction. If you’re flat, you don’t need to prove anything by forcing a breakout trade into the meeting.

5. FX – a “day off” for the dollar slide?

After a long run lower, the dollar is trying to stabilise. That doesn’t mean a new bullish trend; it just means the one-way traffic needs to reset.

- Euro is still sitting near recent highs after strong business activity data.

- Yen has backed away from the extremes that had everyone talking about intervention.

- AUD and NZD are holding their gains as long as the growth story doesn’t crack.

The key tell today is how the market treats any dollar bounce:

If rallies get sold quickly, the “weak dollar into cuts” theme remains dominant. If they stick, it tells you people were more crowded than they realised.

6. How I’m using this – and why I write it

This Morning Pulse is written for one reason: to stop you starting the session already overloaded with noise.

- It gives you yesterday’s moves in context, not just today’s headlines.

- It frames gold, indices and the dollar in one story instead of three separate guesses.

- And it reminds you that “no trade” is an active decision when the market is waiting for a central bank.

If you want to go deeper than this overview – into the exact zones I care about, where I’m wrong on a view, and how I review the session after the close – that’s what I keep for my Desk Pass traders who execute via my broker links.

For now, treat this as your map: keep it next to your charts, and let it filter what actually deserves your attention today.

Leave a comment