Gold at 4,200 – This Week in One Glance

- Gold is holding around 4,200 on the 4-hour chart after a sharp run from the 3,900 area, consolidating just under the 4,270 swing high.

- A recent Goldman Sachs survey of institutional clients shows most expect higher prices into 2026, with a large camp looking for levels above 5,000 – confirming a structural bid from central banks and larger investors.

- Ukraine–Russia peace headlines are creating short bursts of volatility, but the main drivers for gold are still deficits, rate-cut expectations and de-dollarisation rather than war alone.

- This week’s key risk events are US labour data and core PCE; they will either confirm or challenge the current “easier policy ahead” narrative that has supported both gold and equities.

- On my map, 4,170–4,150 is the key support band and 4,245–4,270 the first resistance zone; above support I treat weakness as consolidation, while a sustained break below 4,100 would force a full reassessment of the bullish structure.

Gold is sitting around the 4,200 area, cooling off after a huge run that took it above 4,000 for the first time and briefly toward 4,400 before we snapped back under 4,000 and rebuilt higher.

The 4-hour chart is now a slow grind higher from the early-November low near 3,900, with price chopping just under the recent 4,270 swing high. This week is about one question: is this consolidation fuel for another leg up – or the top of the current move?

1. What the Goldman survey really tells us

A new Goldman Sachs survey of more than 900 institutional clients shows how the bigger money is thinking about gold into 2026. Roughly 70% expect prices to push higher again, and the single largest group – 36% of respondents – think gold will be trading above $5,000 an ounce by the end of 2026.

That matters because this isn’t social-media hype. It confirms a structural bid under the market: central banks adding to reserves, investors worried about deficits and policy mistakes, and a preference for hard assets over long-duration bonds. It explains why every meaningful dump in 2025 has struggled to stick.

But a 2026 target doesn’t help if you’re managing risk around 4,200 this week – so we bring it back to the drivers in front of us.

2. War, peace talk noise and the safe-haven label

Gold still gets called a “war hedge”, but most of the flow right now is about macro, not just headlines.

We have on-off stories about possible progress on Ukraine–Russia peace proposals, plus conversations between the US, Europe and Moscow. Markets react to every headline with a little spike in oil, defence stocks, or Russian assets – then give a chunk of it back when it becomes clear that the gaps on territory and security guarantees are still huge.

If we eventually get a credible peace deal, some of the war premium comes out of assets that have priced in permanent tension – especially energy and defence. Gold would feel that as well, but the bigger reasons institutions are long – debt, deficits, rate-cut expectations and de-dollarisation – don’t disappear because of one treaty. For traders, peace headlines are mainly a volatility trigger on top of a structural trend.

3. This week’s event risk: where things can break

For this week, the heavy lifting is done by US data. The key points on the calendar:

- ADP employment change – an early look at how the US labour market is holding up.

- Strong report: supports growth, pushes yields and the dollar higher, usually pressures gold.

- Soft report: reinforces slowdown fears, helps lower yields and can put a bid under gold.

- ISM Services PMI – important because services have carried the US economy this cycle.

- A weak print adds to the “cuts are coming” story.

- A strong one reminds the market the Fed may not be in a rush.

- Later in the week – core PCE and the rest of the labour data

Core PCE is the Fed’s preferred inflation gauge. A cooler number keeps the door open for easier policy into 2026; a hotter one forces traders to rethink how aggressive they are on rate-cut pricing.

The point is simple: this week’s data either confirms the macro backdrop supporting gold, or it challenges it.

4. How I’m mapping gold around 4,200

On the 4-hour XAUUSD chart I’m focused on three zones:

- Support: 4,170–4,150, then 4,100

- Resistance: 4,245–4,270, then the air pocket toward 4,300+

How that lines up with the macro:

- Above 4,170

The structure still looks like a consolidation inside an uptrend. If data comes in mixed or soft and we’re holding above that band, I expect dip-buyers to defend pushes into 4,170–4,150 rather than panic. - Into 4,245–4,270

This is where late buyers have already been trapped once. On an ADP or ISM spike, I am not interested in chasing the first break into that zone. If the breakout is genuine, the market usually gives a retest or a cleaner setup rather than one candle and done. - Below 4,150 – and especially below 4,100

That is where I stop treating this as “healthy consolidation” and start assuming position flush. If yields and the dollar are breaking higher at the same time, I would rather step back and reassess than force longs into a macro that’s shifting against the trade.

Cross-asset, I’m lining gold up against:

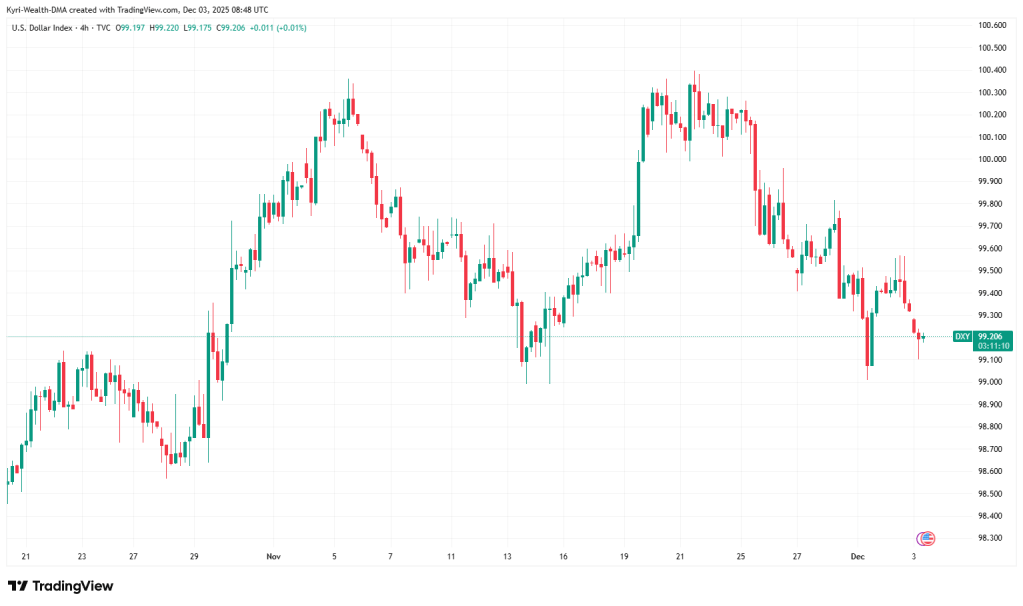

- the dollar index (to see how much is FX versus metal);

- US 10-year yields (real-yield pressure on gold);

- the S&P and Nasdaq (whether gold is trading with risk assets on the “easier policy” story, or against them as a classic hedge).

When those three line up with price at a level, that’s where the cleaner trades tend to sit.

5. How I’m using this, and how to follow along

If you’re trading this move, your edge isn’t guessing ADP to the decimal. It’s knowing:

- which levels matter before the number hits,

- what the bigger players are actually positioned for,

- and how much size you can carry without getting forced out on the first spike.

That’s what I’m building with KyriWealth: one place where you see the same map I use on my own desk – gold, indices, the week’s risk events and the levels that matter.

If you want this laid out twice a day – morning setup and post-data recap – follow KyriWealth and stay close to the updates.

I execute through Vantage for pricing and infrastructure. None of this is advice; you are responsible for your own risk and position size.

Leave a comment