Before apps, watchlists and one-click trading, getting into the market was a bit of a mission.

You didn’t “open an account in five minutes”.

You phoned a human being, paid chunky fees, and waited days to find out what price you actually got.

For most people, investing wasn’t a side hobby you did on your lunch break. It was slow, formal and slightly intimidating – but that same friction also stopped a lot of the impulsive trading we see today.

In this piece, I want to look at how normal people used to enter the market before online brokerages, what that experience really felt like (the good, the bad and the daft), and what – if anything – was better back then compared with now.

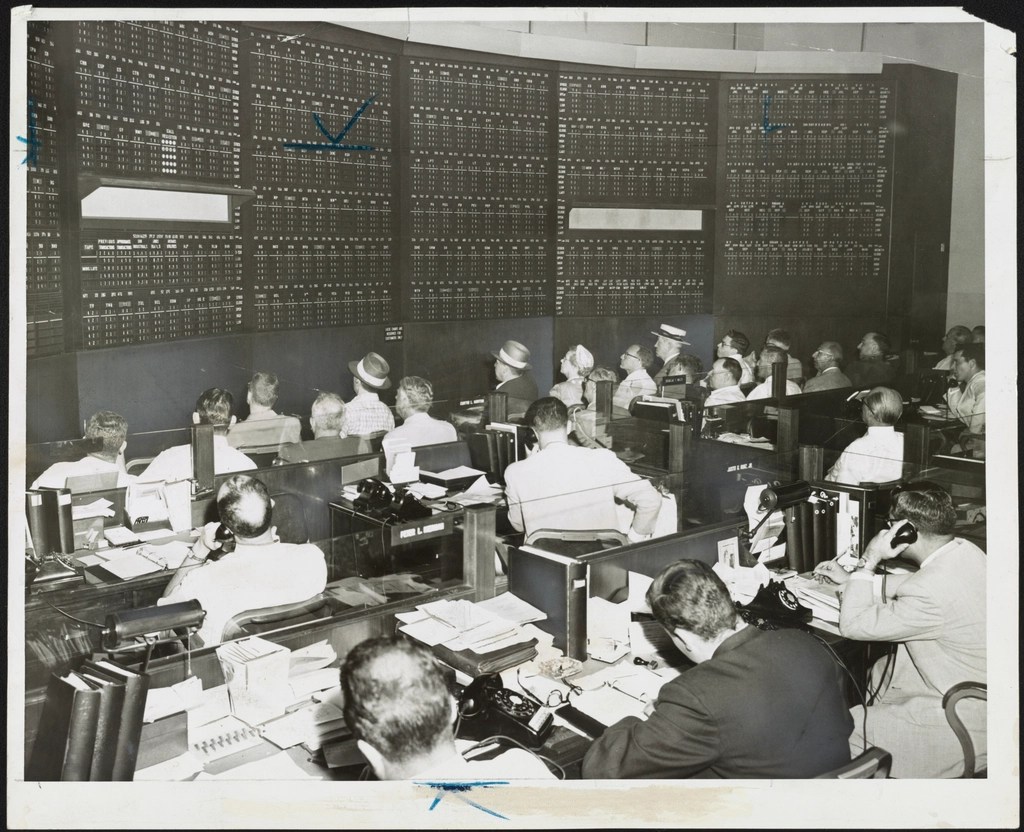

1. The Old World: How You Bought Shares Before Online Brokers

Imagine it’s the early 1990s and you’ve decided you want to buy some shares.

There’s no app store and no CFD platform. Here’s how it typically went.

1. Find a broker – usually via your bank or a “guy”

There was no “Top 10 Broker” comparison page. You either:

- Asked your bank about their investment service, or

- Went to “a bloke in an office above a shop” someone knew, or

- Got introduced to a stockbroker by your accountant or IFA.

If you didn’t have a decent lump sum, you were often told, politely, that it wasn’t really worth their time. Retail investing was a bit of a club.

Typical story:

Your uncle decides to “put something away for the kids”. He doesn’t Google anything (Google doesn’t exist). He rings “a chap” he knows in the City who says, “Leave it with me, we’ll put you into a good investment trust.” Months later he gets a fat envelope of paperwork and hasn’t got a clue what he actually owns – but that’s just how it was.

2. Open an account… with a pen and a stapler

KYC and account opening still existed; it just involved more trees.

- Forms in the post, handwritten.

- Photocopies of passports and utility bills.

- Signatures, more signatures, and maybe even a face-to-face meeting.

Then you waited. Nobody was refreshing an email inbox every two minutes; you were waiting on the post.

3. Place an order by phone – and hope the line’s not engaged

Once your account was live and funded, you called your broker:

“Morning, I’d like to buy 200 shares of XYZ.”

If the market was busy, you might sit on hold listening to bad music while your price moved away.

Real-life style scenario:

You finally get through, give the order, and while the broker’s “working it”, the price jumps. You end up paying more than you expected. No live ticker in front of you, just a verbal fill over the phone and a slightly painful silence afterwards.

If you were really old-school, you might even walk into a local branch to place an order at the counter. No one was smashing 20 round trips on a Friday afternoon.

4. Pay proper money in commissions

Every trade had a noticeable cost:

- Flat dealing commissions (often £20–£50+ per trade).

- Stamp duty on UK shares.

- Wider spreads than most online traders see today.

It meant people thought very carefully before trading.

If it costs you £40 just to get in and out, you don’t scalp for three ticks – you buy with the intention of holding.

5. Wait for confirmation and paperwork (and lose half of it)

After the trade, the real admin started:

- A contract note arrived by post, with all the fees itemised.

- Share certificates turned up later and were often filed in… “interesting” places.

Plenty of families still have a shoebox, biscuit tin or folder somewhere with old certificates and half-faded contract notes. In some cases, people forgot they even owned certain shares until a takeover letter appeared 10 years later.

Funny-but-true genre example:

Grandad passes away and the family finds a pile of forgotten share certificates in a Quality Street tin at the back of a cupboard. Half the companies don’t exist anymore, one’s been taken over three times, and another is suddenly worth a small fortune because it quietly multibagged over 25 years.

Dividends came as cheques, which you had to physically pay in at the bank. No “Reinvest dividends” toggle. If you forgot to cash it – tough.

6. Information was slow, and the pros had the edge

If you wanted to follow your investments:

- You checked prices in the newspaper the next day.

- Maybe you watched Teletext or Ceefax for delayed quotes.

- You bought the Investors Chronicle or similar for research.

Meanwhile, professionals had terminals, live feeds and research departments. The information gap between retail and the City was huge.

The result:

The old world was slower, expensive, and clunky – but it naturally forced:

- fewer trades,

- longer holding periods,

- and more thought before hitting the buy button (because there was no button).

2. The Online Revolution: From Dial-Up to Day Trading

Then came the internet.

Early online brokers in the late 90s and early 2000s looked basic by today’s standards, but they were a big shift.

1. The first taste of “do-it-yourself”

Suddenly you could:

- Open an account from home.

- See live-ish quotes on your screen.

- Place orders without phoning anyone.

You still might have been on a 56k modem, though. So you’d click “refresh” and listen to the dial-up screech while your order page slowly loaded.

Classic early-online scene:

You place a trade on a slow connection, the page hangs, you hit refresh three times “just in case,” and then discover you’ve accidentally placed three identical orders. Somewhere a dealer on the other end is wondering who this lunatic is.

2. Costs collapsed, and activity exploded

Commission dropped dramatically. Discount brokers arrived. Suddenly:

- Smaller accounts could trade more often.

- People who’d never have called a traditional broker started dabbling.

- Day trading became a thing regular people talked about.

The barrier to entry fell – for good and for bad.

3. Platforms, CFDs, forex and leverage

As tech improved, brokers started layering on:

- Multi-product platforms (stocks, ETFs, options, forex, metals).

- Leverage and margin trading.

- Fancy charts and indicators that would have been institutional-only 20 years earlier.

Retail traders went from waiting for tomorrow’s newspaper to being able to stare at a 1-minute chart of gold at 2am.

3. Was It Better Then or Better Now?

So which era was “better”? It depends what you care about.

What was better before online brokerages

- Built-in patience: High costs and friction meant people didn’t trade for entertainment.

- Less temptation: No phone in your pocket buzzing with price alerts.

- Some human filter: A half-decent broker might gently talk you out of your worst ideas.

What is better now

- Access: Almost anyone can invest with modest sums.

- Costs: Commissions are low or zero in many markets; spreads are tighter.

- Tools & data: Charting, screeners, news feeds, fundamentals – all in one place.

- Choice: Stocks, metals, forex, ETFs, options – across global markets.

What’s worse now

- It’s almost too easy: One wrong tap and you’ve doubled your position size.

- Noise and FOMO: Social media, meme stocks, endless “hot takes”.

- Overtrading: When it costs pennies per trade, people treat the market like a game.

The honest view:

The infrastructure and access are far better now.

The behaviour risks are higher than ever.

Which brings us neatly to scams.

4. Old-School Scams vs New Online Traps

Markets have always attracted chancers. What’s changed is the packaging.

Old-school: boiler rooms and “can’t lose” phone calls

Back in the day, a typical scam looked like this:

- You’d get a cold call from a very confident man with a very posh voice.

- He’d offer you a “special opportunity” in some thinly traded share.

- Slick brochures would arrive in the post to make it feel real.

They pushed people into illiquid, overhyped stocks and quietly dumped their own holdings into the artificial demand they created.

The red flags were:

- High pressure: “We need an answer today.”

- No proper regulation.

- Lots of talk about “inside contacts” and “institutional interest”.

New-school: the modern online version

The basic formula hasn’t changed, but the delivery has.

Some of the common online traps now:

1. Slick but fake “brokers”

Professional-looking sites with:

- fake regulation numbers,

- copied text and logos,

- and an easy sign-up funnel.

You deposit, maybe even trade on a convincing-looking platform… and then:

- Your withdrawal request goes missing, or

- They freeze your account and blame “compliance checks”, or

- The site simply disappears.

2. Clone firms

A regulator will authorise Broker A.

A scammer builds Broker-A-Ltd.com, copies the real firm’s details, and contacts people using their name.

Everything looks legitimate until money goes in and doesn’t come back out. These are nasty because they piggyback on real brands.

3. “Account managers” and WhatsApp/Telegram gurus

You might see:

- A stranger on Instagram showing “proof” of huge returns.

- A Telegram group promising “managed accounts” with zero risk.

- Someone offering to “trade on your behalf” if you just hand over login details or send crypto.

Once your money is in, they:

- Overtrade or gamble it away, or

- Falsify screenshots of profits to lure more deposits, or

- Simply vanish.

4. Bonus traps and withdrawal walls

Some offshore brokers use “bonuses” and tiny print to box people in:

- You get a big deposit bonus…

- But the terms say you can’t withdraw until you hit some insane turnover requirement.

- Every time you get close, they adjust something or suddenly “detect suspicious activity”.

The result is the same as the old boiler rooms: money goes in easily, money does not come out easily.

5. What Today’s Trader Can Steal from the Old Days

Despite all the tech, there are a few habits from the pre-online era that are worth keeping:

- Treat each trade as if it still cost £40

- Would you really take that trade if it cost you £40 to enter and exit?

- If the answer is no, maybe it’s just noise.

- Slow down the decision, speed up the research

- Use modern tools for data and charts.

- Use old-school patience before committing capital.

- Respect boring

- Some of the best money in the old days was made by buying solid names and holding, quietly.

- Not every position needs to be “exciting”.

- Be pickier with brokers than ever

- Cheap and fast is good – but only if the firm is real, regulated and stable.

- If anything feels pushy, urgent or unclear, walk away.

Wrap-Up

Before online brokerages, getting into the market was slower, more expensive and more exclusive – but that same friction protected people from some of today’s worst habits.

Today, almost anyone can trade almost anything from their phone, for pennies. That’s powerful… and dangerous if you don’t combine it with old-fashioned discipline and a healthy scepticism.

That’s where Kyriwealth fits in: using modern tools and access, but with the mindset of someone who remembers (or at least respects) the old world.

Helping you focus on:

- sensible wealth creation,

- solid broker choices,

- and avoiding the nonsense that’s just there to separate you from your capital.

Leave a comment