Today the shops are full, the carts are loaded, and the headlines are all “Black Friday record!” or “Consumer finally tapped out!”.

The real question for us is simpler:

Does all this shopping actually move the stocks we invest in – and should we be trading it, investing around it, or firing up a CFD platform to try and catch a quick move?

Let’s use today’s charts to keep it real.

What the charts are telling us

You’ve got two pictures in front of you:

- Top chart – XRT: a broad US retail ETF (online + high street).

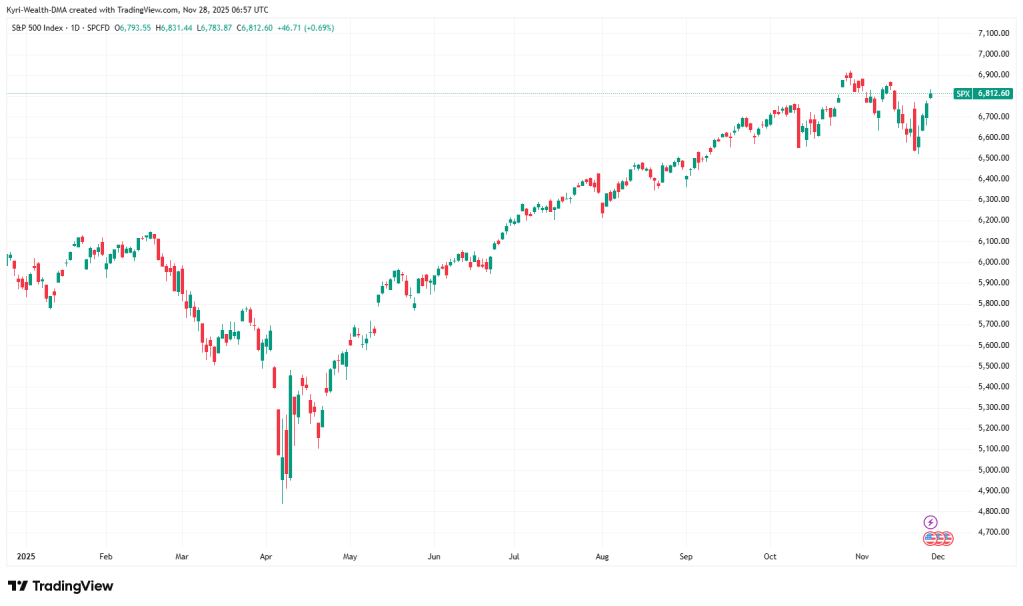

- Bottom chart – S&P 500: the big, diversified benchmark.

A few things stand out:

- Both were hit hard earlier in the year, then recovered strongly.

- The S&P 500 has climbed more steadily and is hovering around its highs.

- XRT (retail) is more volatile: bigger drops, sharper rallies. Recently it bounced hard off the lows again – a nice pre-Black-Friday push, but still not comfortably above its prior peaks.

In other words:

the market believes in the overall economy more than it “loves” retail stocks, but traders are clearly willing to bet on a short-term boost around the shopping season.

That’s the backdrop. Now, what do we actually do with it?

Does Black Friday spending really move our investments?

Short answer: sometimes in the short term, rarely in a straight line, and over the long term it’s the trend in earnings that matters, not this one weekend.

Here’s how it usually plays out:

- Expectations come first.

Retail stocks move before the big sales days, based on guidance from management, macro data, and analyst expectations. A strong bounce into Black Friday often means good news is already priced in. - The reaction is to the surprise, not the headline.

If everyone expects strong sales and the numbers are just “OK”, retail can actually sell off after the weekend. If expectations were low and the consumer holds up, you sometimes see a relief rally. - The index cushions the noise.

In a broad fund like the S&P 500, retail is only a slice. So even a dramatic Black Friday story tends to be a side-show if you hold a diversified index or global ETF.

So yes, what happens at the tills matters – but mostly as one data point in a bigger story about the consumer, inflation, and interest rates. It’s rarely a “get in Friday, get rich Monday” event.

Investor vs trader vs CFD user – three different questions

The more useful thing is to ask: who are you in this picture?

1. If you’re a long-term investor

Your questions sound like:

- “Do I own too much retail?”

- “Is my portfolio basically one country or one theme?”

- “Does this chart change my plan?”

For you:

- A choppy, sideways retail ETF while the S&P 500 grinds higher is a reminder that concentration in one sector is risky.

- Black Friday is just a checkpoint. If the long-term trend in XRT still looks messy compared with the broader index, it argues for staying diversified rather than trying to stock-pick every retailer.

- You might use this as a moment to review your allocations: is retail a small part of a global mix, or did you accidentally build a portfolio that looks like “Amazon + a few malls”?

Action for investors today:

“Check your exposure, don’t chase the noise. Your edge is time, not timing.”

2. If you’re a short-term trader

Your questions are:

- “Is there a trade here for the next few days or weeks?”

- “Where are the levels – support / resistance – around this season?”

Looking at XRT:

- We’ve just seen a sharp bounce from recent lows – that’s often where traders try to ride momentum.

- But it’s still in a broader, choppy range. That means breakouts can fail quickly, especially once the Black Friday headlines fade.

If you’re trading this, you’re really playing sentiment around expectations, not the long-term value of the companies. That can work – but it needs tight risk management and an exit plan.

Action for traders today:

“Define your risk before you click. This is a sentiment trade, not a life-changing thesis.”

3. If you’re tempted to jump onto a CFD platform

Black Friday + strong green candles can trigger the classic thought:

“Maybe I should just open a CFD, go long retail, and see if I can double this move.”

Before you do:

- CFDs are leveraged. A 2–5% move in the ETF can translate into a much bigger swing in your P&L – in both directions.

- Because Black Friday is so headline-driven, intraday spikes and reversals are common. Great if you’re disciplined and experienced; brutal if you’re new and trading with emotion.

- The same chart that looks “obvious” after the fact is a lot less obvious when you’re staring at a red unrealised loss and a margin warning.

CFDs can make sense for experienced traders who:

- Understand position sizing and margin.

- Have a written plan and accept they can be wrong quickly.

- Treat it as trading capital, not rent money or savings.

For everyone else, it’s usually smarter to express a view through shares or ETFs in a normal investment account, where you’re not fighting leverage and overnight financing charges on top.

Action for would-be CFD users:

“If you don’t deeply understand the risks, you don’t need leverage to benefit from the consumer story.”

So… should we do anything today?

Here’s the simple way to think about it:

- If you’re already diversified:

Black Friday is a good talking point, not a reason to rip up your plan. Make sure retail isn’t an accidental overweight, then leave the minute-by-minute drama to the traders. - If you like the retail theme long term:

Consider whether you prefer a basket (like XRT) or a couple of strong names rather than betting the farm on one struggling chain. Use days like today to learn how the sector behaves, not just to speculate. - If you really want to trade it:

Decide in advance:- Where you’re wrong (your stop).

- How much you’re willing to lose if the trade fails.

- Whether you truly need CFDs, or if plain shares/ETFs on a simple platform get the job done with less stress.

Before you shop for trades, shop for the right platform

One last thing. Whether you:

- Buy a retail ETF for the long term,

- Take a short-term trade in a single stock, or

- Decide to experiment with CFDs,

the platform you use matters – fees, spreads, ease of use, regulation, and how they handle your orders all change your real-world outcome.

Before you rush to open something new just because it’s Black Friday, take five minutes to review the platforms I’ve written about below.

See which ones are better suited for:

- Long-term investing and ETFs,

- Active stock traders, and

- Higher-risk CFD trading.

Then decide how you want to play the retail story – as an investor, a trader, or not at all – with a platform that actually fits you, not the marketing.

Leave a comment