If you trade FX or hold significant cash in multiple currencies, this is one of those weeks where silence is misleading.

The dollar is quietly heading for its strongest weekly performance in over a month, while the yen sits pinned near a 10-month low — and Tokyo is openly hinting at intervention.

When the world’s third-largest economy starts sharpening that tool, every UK and EU investor with USD or JPY exposure should pay attention. Intervention doesn’t tend to reverse a trend, but it can deliver sharp, opportunistic moves that reward the prepared and hurt the complacent.

Why the yen is under such pressure right now

The yen’s slide isn’t news — the move has been building for months — but the reasons behind this leg lower are unusually layered.

This week brought two big inputs:

1. Fiscal worries in Tokyo

Prime Minister Takaichi’s cabinet has just approved a ¥21.3 trillion stimulus package. Supportive for the domestic economy, yes. Supportive for the yen? Absolutely not. Markets see more spending, more debt, and slower progress towards tightening — so the currency remains on the defensive.

2. Traders testing the line

At 157.9, USD/JPY tapped its weakest level in 10 months. Each dip into new territory invites speculators to push further, and officials to talk tougher. Japan’s finance minister said intervention was “a possibility” to stem “excessively volatile and speculative” moves. That single sentence was enough to spark a small yen pop — but not enough to reverse the trend.

Japan last intervened in July 2024, spending ¥5.53 trillion (around $37bn) to lift the yen from 38-year lows. Markets know Tokyo can act, but history shows these moves are “speed bumps, not barricades”.

The dollar side of the story: why it keeps grinding higher

On the other side of the pair, the dollar has just enjoyed its best week in over a month.

Two factors are doing the heavy lifting:

1. Fed cut expectations have cooled

The delayed US jobs report showed employment growth ticking up and unemployment rising to 4.4%, a four-year high. Not a crisis, not a boom — just enough ambiguity to keep the Fed cautious. Markets have now priced only a 27% chance of a cut in December. Less easing equals more dollar resilience.

2. Global uncertainty makes USD the “least complicated” option

Between Japan’s fiscal moves, the UK budget ahead, and mixed data out of Europe, USD remains the easy decision for large flows. It’s not that the US looks brilliant — it’s just that everywhere else looks messy.

What this means for short-term traders and medium-term investors

This is one of those classic FX moments where the macro story and the chart are unusually aligned.

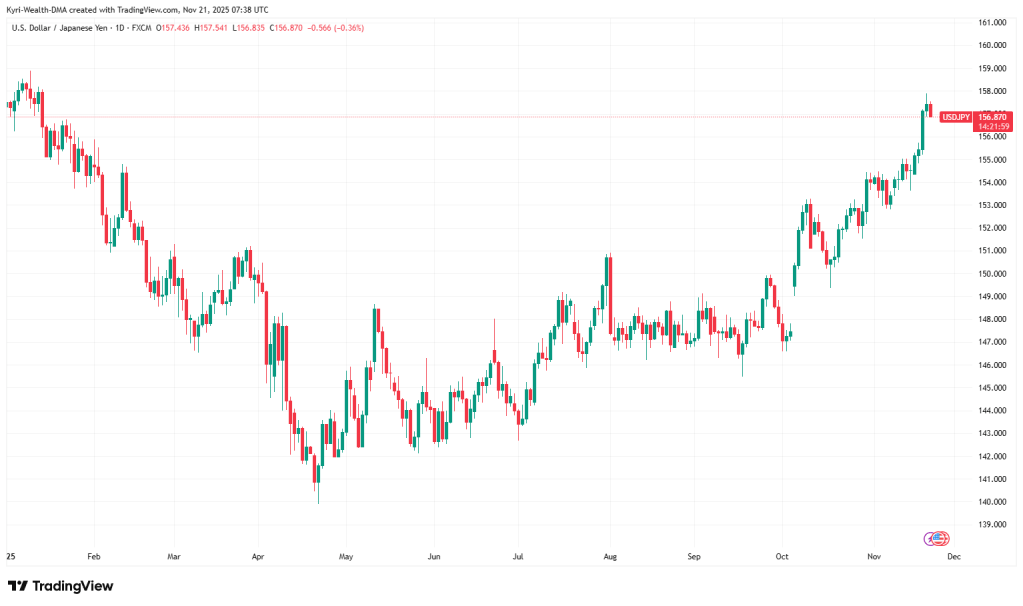

Your chart (USD/JPY daily) tells the same story the fundamentals do:

a slow, steady climb with momentum accelerating into late November.

Here’s the key point:

Even if intervention comes, it rarely kills a trend unless fundamentals back it. What it does provide is volatility — often sharp and short-lived.

That’s why traders eyeing this pair don’t wait for an RNS headline. They plan around scenarios.

A practical scenario: how a £50k–£100k trader might approach this

Let’s take a realistic example.

Scenario (not advice — just illustration):

A trader has £50,000 earmarked for FX exposure and wants to play USD/JPY momentum with risk controls.

Two possible approaches:

1. Cash-based position via a multi-asset platform (e.g., Exante)

- Small, unleveraged buy position in USD/JPY.

- Objective: participate in trend continuation while keeping downside capped.

- Risk: a sudden ¥1–3 intervention spike could knock 1–2% off quickly.

Why cash works here:

Even if Tokyo steps in, cash positions avoid forced liquidation. It’s the calmer way to ride a macro trend.

2. Tactical leveraged move via a broker like Vantage

- A lightly-leveraged long with a firm stop.

- Objective: catch the continuation leg toward 158–160 if the market keeps testing the Bank of Japan.

- Risk: a sudden ¥3–5 move on intervention could hit stops within seconds.

Why leverage only suits the disciplined:

Intervention candles are fast. If you’re wrong, you need to be out quickly, automatically, and unemotionally.

In both cases, the key is planning for the intervention reaction, not trying to predict its exact timing. That’s what experienced traders tend to do differently.

So — how do you trade this moment without making it emotional?

Three principles have helped the most consistent FX traders I speak with:

1. Trade levels, not headlines.

If the market wants 158–160, it will usually get there before the officials act.

2. Assume intervention is short-lived.

Historically, unless fundamentals support a reversal, the yen eventually drifts back to where it was.

3. Use tools that match your temperament.

Cash on Exante fits patient trend-followers.

Light leverage on Vantage fits tactical traders.

Neither approach is “smarter” — they just suit different temperaments.

FAQ — Fast answers for investors and traders

Is Japan definitely going to intervene?

No one knows. But verbal warnings are becoming more frequent — a classic precursor.

Does intervention usually reverse USD/JPY trends?

Rarely. It tends to cause short-term spikes, not long-term reversals.

Is the dollar rally sustainable?

As long as Fed cuts remain in doubt and global data stays messy, USD stays supported.

Should a UK investor hedge yen exposure now?

It depends on your timeframe and risk tolerance — hedge only if moves like ¥3–5 in a day would materially impact you.

Disclaimer: This content is for informational purposes only and reflects independent market observations. It is not investment advice. Always do your own research or consult a qualified adviser before making financial decisions.

Leave a comment