The Stage, The Stakes, The Setup

Right now, the quantum computing field is straddling two worlds. On one side: hype driven by breakthrough claims and speculative valuations. On the other: the very real beginnings of commercial traction.

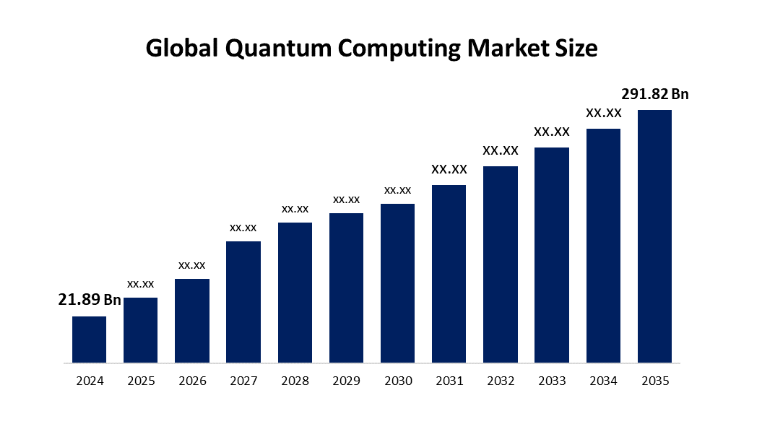

According to several market studies, the global quantum computing market is expected to be worth around US$1.8 billion in 2025, up roughly 27-35% from prior years. And longer-term forecasts stretch into the US$20-100 billion+ range in the 2030s.

But here’s the problem: for most investors, quantum isn’t yet delivering big revenue streams. It’s still in “prep phase” more than “exploit phase.” As one headline put it, “Pure-play stocks … long way from meaningful corporate adoption.”

The opportunity is real — but timing and size matter. Let’s walk through what this means, how it compares to AI, and how you might structure a play.

Quantum vs. AI: Comparing Realities

AI is already a giant. Software, cloud, data-models, services — many companies are earning real money now from AI. By contrast, quantum is hardware-heavy, nascent. It’s the “hardware under the hood of the future” rather than the application layer today.

- AI = near-term monetisation, many business models, many winners.

- Quantum = longer-term optionality, fewer proven paths, higher risk/higher reward.

Consulting firm McKinsey notes quantum might reach about $100 billion impact in a decade — big, but still behind the scale of AI today. In short: if you want returns in the next 12-24 months, AI is more fertile ground. Quantum is a moon-shot.

What Are the Public Companies Doing Now?

IonQ, Inc. (Ticker: IONQ)

- Q3 2025 revenue rose ~222 % YoY to ~$39.9 m; but net loss ~$1.1 billion.

- Guidance: raised to ~$106-110 m for full-year revenue.

- Technical milestone: 99.99 % two-qubit gate performance (Oct 2025).

Analysis: Good growth, but still heavy losses — “proof of concept” progressing, commercialisation limited.

D-Wave Quantum Inc. (Ticker: QBTS)

- 2025 share gains +66 % or more.

- Announced commercial availability of its “Advantage2” quantum system for cloud access.

Analysis: Moving faster toward usable hardware and cloud offering — but still early stage.

Other Names

Rigetti Computing (RGTI), Quantum Computing Inc. (QUBT), and large tech firms such as Alphabet (GOOGL), Microsoft (MSFT) and IBM have quantum ambitions. Analysts often favour the large diversified firms for risk mitigation.

Is It a Bubble? Is It Too Early?

Too Early

- Commercial use-cases remain experimental, not mass-deployed.

- Hardware is expensive, error-prone, and scaling challenges remain.

- Market size is small compared to the hype (US$1-2 bn vs thousands of billions).

Bubble Risk

- Pure-plays have seen massive gains — some up 5000% in a year.

- Valuations disconnected from earnings (there are hardly any).

- Sentiment-driven volatility — a single missed milestone can move prices 30%+.

Bottom line: venture-style risk. If you go in heavy, expect large drawdowns.

How to Play It: Strategy for Traders & Investors

Horizon & Size

- 5-10+ years: Small allocation (1-2 %) to pure-plays can make sense.

- ❤ years / risk-averse: Stick to big tech firms for quantum optionality.

Entry Tactics

- Use dollar-cost averaging; avoid all-in entries.

- Apply stop-loss or defined-risk positions — volatility is brutal.

- Keep quantum as an option, not a core holding.

Triggers to Watch

- Commercial contracts outside the lab (defence, pharma, logistics).

- Revenue acceleration or new government funding.

- “Quantum advantage” proven in business-scale tasks.

- Quantum-safe encryption demand (the so-called “Q-Day” threat).

- Big tech integrations into cloud offerings.

What to Avoid

- Hype with zero revenue.

- Over-sized bets on loss-making microcaps.

- Buying because it sounds futuristic — fundamentals still count.

Will Quantum Be Bigger Than AI?

Maybe — but not soon. AI is already monetised and embedded across industries. Quantum is still chasing its “killer app.” If it hits — drug design, cryptography, optimisation — it could rival parts of the AI ecosystem. But for now, AI remains the safer, cash-flowing engine, and quantum the experimental turbo-charger still in testing.

Thesis & Trade Takeaway

Thesis: As of November 2025, quantum computing is a valid but high-risk speculative play. It sits in the “optional upside” part of a portfolio, not the core. The journey will be long and volatile, with uncertain timing — but the payoff, if realised, could be enormous.

Trade Takeaways:

- Allocate small to pure-plays (IONQ, QBTS, RGTI) only if you can stomach volatility.

- Prefer big tech names for balanced exposure (MSFT, IBM, GOOGL).

- Watch for clear milestones before increasing allocation.

- Short-term profit hunters: stay with AI, Cloud, or semiconductors; quantum is a 5-10 year story.

In short: Quantum’s potential is real — but the timing is uncertain. Invest small, stay patient, and treat it like venture capital: asymmetric upside, real risk.

Tags: Quantum Computing, AI, Investing, Technology, Markets 2025, Trading, Innovation

Leave a comment