If you’d bought Nvidia two years ago, you’d be grinning from ear to ear. But if you’d caught Credo Technology (CRDO) at the same time, you’d be laughing even louder. The difference? One’s the poster child of AI. The other’s the pick-and-shovel quietly wiring the system that makes it all work.

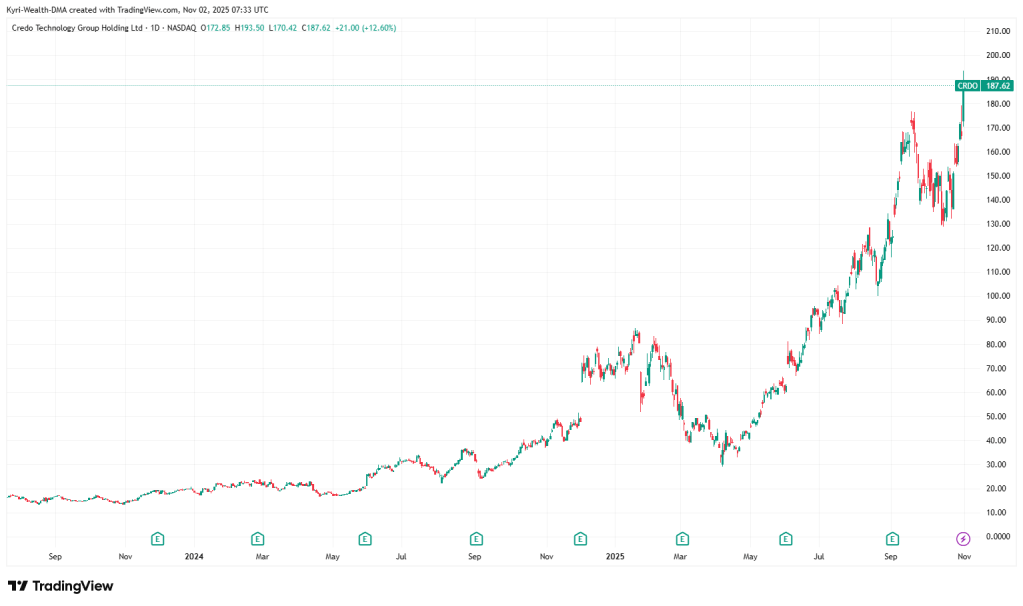

The market loves the obvious. Nvidia prints headlines and valuation multiples that make your eyes water. Meanwhile, Credo was sitting under £2 billion market cap not long ago — an optical semiconductor name most retail investors couldn’t even spell. Now? The chart tells the story. The stock’s gone near-vertical since midsummer, doubling off its spring lows and breaking into fresh highs as of November 2025.

At the time of writing, CRDO trades around $187.62 — up 12.6% on the day — giving it an $18.5 billion market cap and a punchy 147× P/E. That’s not a typo. It’s a stock that’s gone from overlooked to over-loved in under a year. The obvious question: is it still worth chasing?

The plumbing behind the AI brain

AI needs bandwidth, not slogans. Every time a GPU cluster trains a model, petabytes of data scream across fibre-optic cables. That traffic doesn’t move by magic — it moves through high-speed connectivity chips like the ones Credo designs. Think of it as plumbing for the digital brain. Nvidia sells the muscle; Credo sells the arteries.

Their edge is power efficiency. Credo’s next-gen SerDes chips transmit signals with lower loss and less energy than rivals, which matters when data centres are hitting thermal ceilings. Needham analysts called it a “significant power advantage.” That’s code for: hyperscalers are listening. Google, Meta, and Amazon don’t like wasting watts.

The real catalyst came when AI infrastructure spending shifted focus. The GPU craze hit first. Then came power, cooling, and now connectivity. You can’t keep stacking compute without solving the bandwidth bottleneck. Credo sits bang in the middle of that pivot.

Valuation: priced for perfection

Let’s not sugar-coat it — Credo’s valuation is demanding.

- Forward P/E: ~70×.

- Price-to-Sales: over 40×, versus 3× for the S&P 500.

- Revenue growth: forecast +36% CAGR through 2027 — roughly six times the index.

- Analysts expect revenues to surpass $800 million in FY 2026, almost double FY 2025.

DCF models peg intrinsic value far lower — some around $25–30 per share. That tells you everything: this is momentum money at work. When expectations are this high, execution must be flawless.

Still, that’s the irony of early-stage AI infrastructure plays — they look ridiculous on paper until they don’t. The story is strong, but the entry matters.

Chart check: momentum or mania?

The technical picture mirrors the fundamentals — steep but not random. After topping in early 2025, CRDO retraced into the $40s, flushing out weak hands. Since May, it’s been an orderly climb back, with rising volume and higher lows. The recent breakout through $180 confirmed new institutional demand.

But at $187, you’re not early. You’re joining the train halfway up the mountain. The market’s already priced a multi-year growth cycle and flawless delivery. Any wobble — a missed quarter, a guidance tweak, or macro tightening — could trigger a sharp pull-back.

That’s the fine print of owning hyper-growth in a late-cycle bull. The fundamentals can be right while the stock corrects 30% just to shake off excess.

Is it still relevant? Absolutely.

The optical-connectivity story isn’t fading — it’s just starting. Hyperscalers are redesigning their data-centre fabrics around speed, density, and power efficiency. Credo’s position in that architecture isn’t a fad; it’s a requirement.

As long as AI models get larger, the need for ultra-fast, low-loss interconnects only rises. That’s a structural theme — not a quarterly trade.

So yes, Credo remains relevant. It’s still one of the cleanest ways to play the “AI plumbing” thesis. But at current levels, you’re buying future execution, not value.

Kyri’s take

If you’re a trader: don’t chase green candles. This thing has run hot — the RSI is overbought, sentiment euphoric, and valuation stretched. Wait for a retest of $160 support or a 10–15% cool-off before leaning in again. Momentum stocks like this breathe fast and hard.

If you’re an investor: size it small and think long. The secular case — data-centre optical upgrade, AI scaling, and bandwidth constraints — remains intact for 2026 and beyond. But you’ll need conviction through volatility and a stomach for 30% drawdowns.

Credo’s execution so far has been sharp, its technology relevant, and its growth enviable. But when a company trading at 40× sales starts to look “safe,” you know the market’s running hot.

Final line

Everyone wants to own the headline — few bother to own the backbone. Nvidia sells the dream. Credo sells the throughput that makes it possible.

If AI is the gold rush, CRDO is the company building the rail lines to the mines. Just don’t forget — even the best rails correct before the next train arrives.

It’s not about chasing the shiniest stock. It’s about buying the next pullback before the crowd does.

Leave a comment