Apple’s back in the headlines.

Holiday sales, double-digit iPhone growth, and the market’s acting like Santa came early. Fine — but if you’re buying Apple at $270-plus, you’re not investing. You’re joining a crowd.

So the real question: what’s the smartest way to hold Apple without betting your year-end bonus on one ticker?

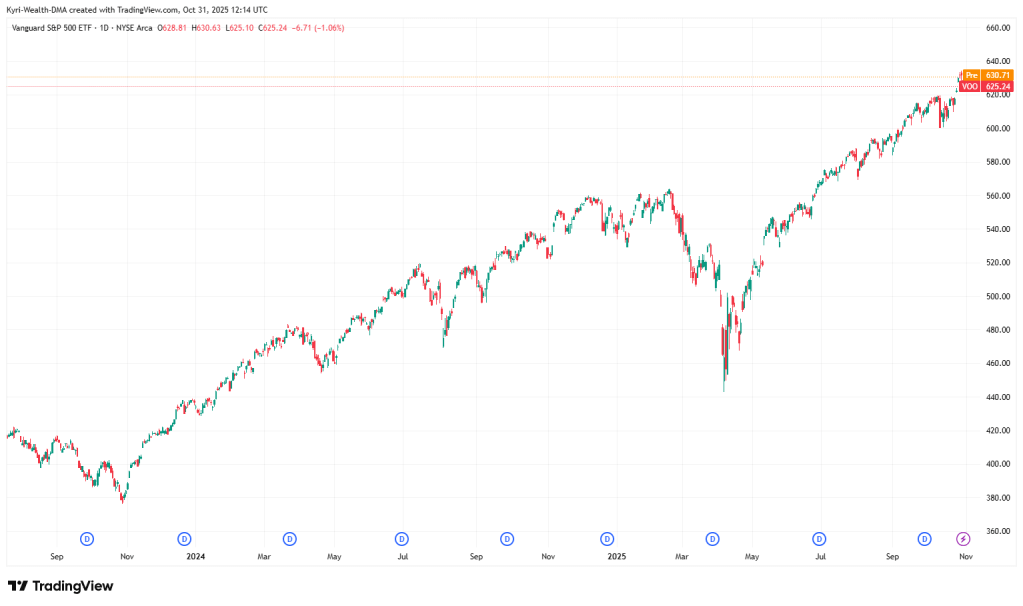

Option 1: Go Broad — VOO or IVV

You get Apple exposure without the single-stock headache.

The Vanguard S&P 500 ETF (VOO) or iShares Core S&P 500 (IVV) both hold 6–7% in Apple. That means you catch the upside if Cupertino delivers, but you’re cushioned if it doesn’t.

Cost? About 0.03%. Can’t argue with that.

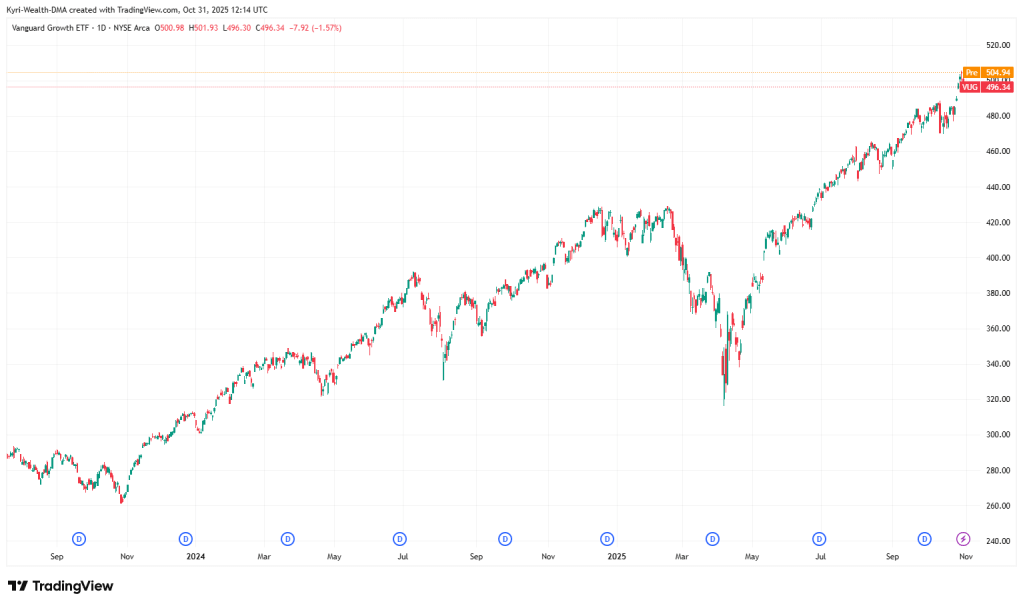

Option 2: Go Growth — VUG

Vanguard’s Growth ETF (VUG) is heavy in Apple, Microsoft, and Nvidia.

If you think AI, chips, and devices still run the next cycle, this is your jet fuel.

Downside: you’re paying up for momentum. Growth’s crowded, and if yields tick up, this lot gets hit first.

Option 3: Go Quality — SCHD

Not everything has to be a moonshot.

The Schwab Dividend ETF (SCHD) gives you solid U.S. names with real balance sheets. Apple’s in there too — but surrounded by dividend reliability.

If you like income and sleep at night, this is a good counterweight.

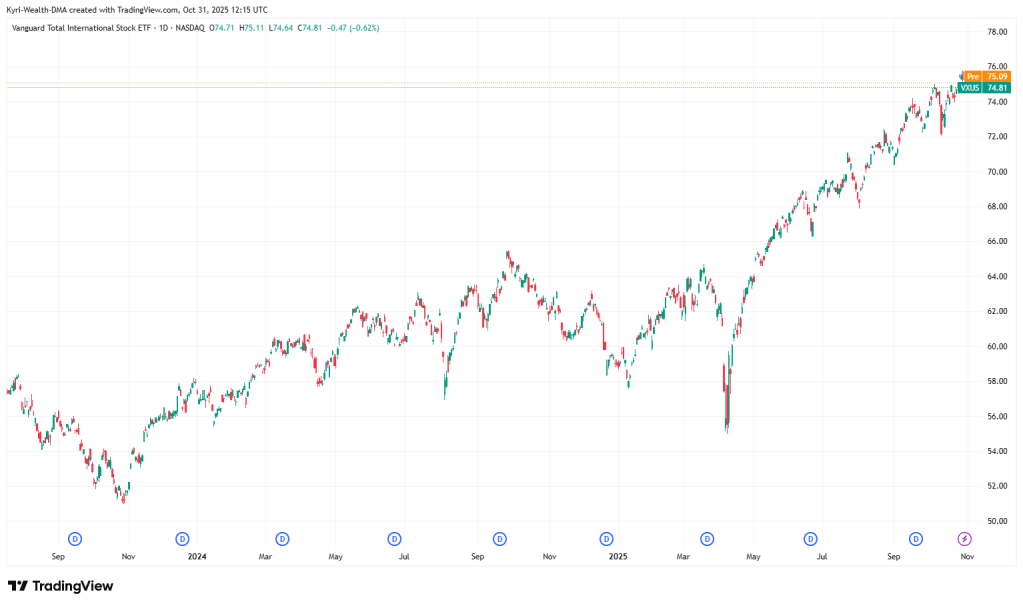

Option 4: Go Global — VXUS

Apple’s a U.S. beast, but your portfolio shouldn’t be.

VXUS spreads you across Europe, Asia, and emerging markets.

Think of it as your inflation hedge, FX hedge, and “what if America sneezes?” hedge all in one.

Kyri’s Take

Apple’s still the benchmark for consumer tech — but not the whole market.

If you believe in their next cycle, own it directly.

If you want to invest, not guess, wrap that Apple exposure in ETFs that balance risk and return.

My blend today:

VOO (core), VUG (growth tilt), SCHD (income), VXUS (diversifier), Apple (conviction).

As for where you hold it — that matters.

Platforms like EXANTE, Saxo, or Interactive Brokers offer global market access, deep ETF liquidity, and professional-grade custody under regulated frameworks.

The focus isn’t just execution — it’s safety, transparency, and control over your own assets.

Bottom line:

Don’t just ask what to buy — ask where and how you’re holding it.

Good structure and custody give you the real edge when markets turn.

Leave a comment