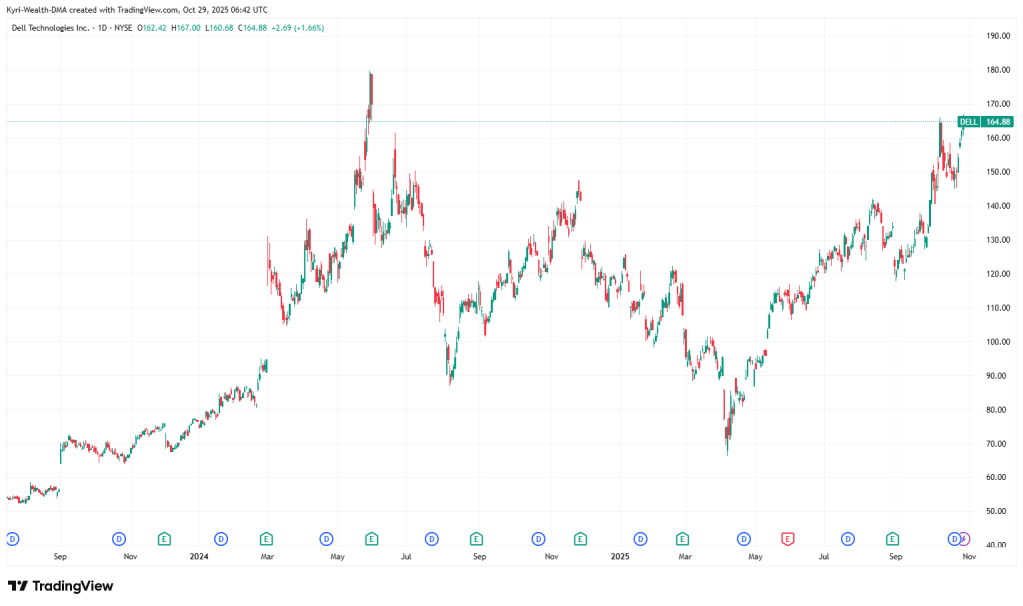

Dell (NYSE: DELL) — £130 to £165 in under six months.

The chart tells you what most still don’t believe: the old PC maker’s in an AI bull trend of its own. Higher lows, clean breakouts, and volume picking up. While the crowd watches NVIDIA’s volatility, Dell’s quietly grinding higher.

The Quiet Transformation

If you’ve been around markets long enough, you know the loud trades rarely pay the quiet bills.

AI headlines are all NVIDIA and shiny GPUs. But under that noise, Dell — yes, Dell — is quietly becoming the backbone of the entire thing.

The same firm everyone wrote off as a “PC dinosaur” is now selling the servers, storage, and infrastructure that make AI actually run. It’s not sexy. It’s plumbing. But plumbing makes money.

The global AI arms race isn’t just about software models — it’s about power, heat, chips, and data movement. Every large-language model or AI-driven app sits on a stack of metal — racks, cables, cooling systems, servers — and Dell is one of the few companies big enough to deliver it all at scale.

This year, Dell’s AI server revenue is estimated above $20 billion, up nearly half year-on-year. That’s not theory; that’s purchase orders from hyperscalers and governments.

While Silicon Valley’s darlings burn cash building “models,” Dell is invoicing the firms that run them.

Market Context: Why the Timing Matters

The macro backdrop’s shifted. Inflation’s easing near 3%, rate cuts are on deck, and growth stocks have regained their pulse.

Investors, though, have learned their lesson — they’re done paying 50× earnings for hype. They want cashflow with a tailwind. That’s where Dell quietly sits.

Dell trades around 18× forward earnings, generates over $7 billion in free cash flow, and returns roughly 80% of that to shareholders. That’s Apple-level discipline, without the cult premium.

So while the market’s chasing “AI moonshots,” Dell’s quietly doing what every smart investor loves — compounding.

The Boring Math

Dell’s two engines — Infrastructure Solutions and Client Solutions — are both firing.

The first drives AI-era growth (servers, data centres, storage). The second sells corporate workhorses — laptops, monitors, peripherals — generating the cash that funds the future.

Margins are widening, because AI-optimised systems carry fatter profits. Dell can deliver full racks within 36 hours — a logistical flex even hyperscalers envy. That’s execution, not narrative.

And with Windows 10 support ending, a PC upgrade cycle is kicking in. Suddenly the “dead” PC division looks alive again — especially with new AI-enabled machines arriving.

The Skeptic’s Case

Sure, it’s not risk-free:

- AI-server demand could cool if budgets tighten.

- Hardware margins are cyclical.

- Dell’s debt (~$22B) is still chunky.

- And the market still anchors Dell to the 1990s box-maker image.

But that’s the opening — Mr Market’s memory problem.

He’s still pricing yesterday’s business, not tomorrow’s. That’s how smart money sneaks in.

The Founder Edge

Michael Dell’s still steering — 40 years on. He’s built what he calls the “AI factory,” partnering with NVIDIA and AMD to supply the muscle behind machine learning.

He’s not chasing hype; he’s leasing the tracks to it.

That’s the difference between dreamers and operators. NVIDIA sells the chips. Dell sells the systems that make those chips earn money. That’s sticky, recurring business — the kind that compounds quietly.

How to Trade It

- Bias: Long, trend-following.

- Entry Zone: $155–$160 on pullbacks.

- Add Zone: $145 if broader market wobbles.

- Target Range: $190–$210 in the next 6–9 months, assuming AI infrastructure demand holds.

- Stop: Below $140 — that’s where the trend breaks.

Use sizing, not conviction. Dell moves slower than the high-beta names — but it’s steadier.

If you’re UK-based, hedge your FX exposure. A swing in GBP/USD can shift your returns by 3–5%.

Kyri’s Take

I like dull money that lasts.

Dell isn’t going to 10× overnight, but it’s the sort of operator that doubles while the dream stocks vanish.

At roughly $164 a share, it sits right in that sweet spot between value and growth.

For a £100K allocation, I’d split it:

- £50K in Dell or an AI-infrastructure ETF,

- £25K cash/gilts for flexibility,

- £25K in defensives — your sleep-at-night ballast.

Balance and optionality — that’s the real edge now.

Trade Access

If you want clean custody access — direct equities, USD cash, or leveraged Dell exposure —

you can do it through EXANTE, my preferred execution desk for multi-asset traders.

Trade Dell via EXANTE → (https://exante.eu/p/39557/fromkky/Insert your referral link here)

Final Line:

In the AI gold rush, Dell’s not digging — it’s selling the shovels. And that’s how you stay rich when the hype cools.

Leave a comment