Market Snapshot — as of 23 October 2025

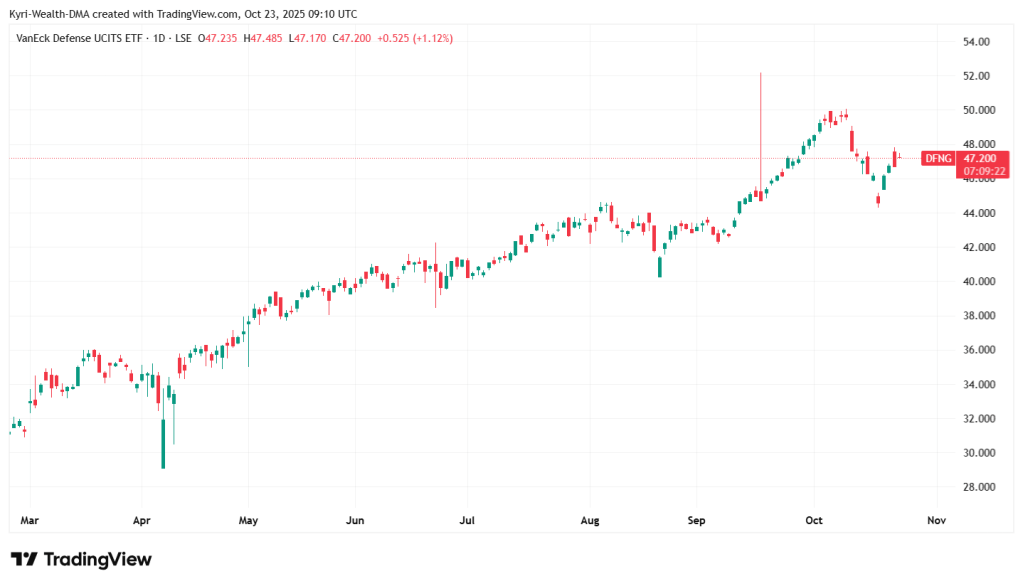

DFNG – VanEck Defence UCITS ETF (LSE): £47.20 | YTD +72%

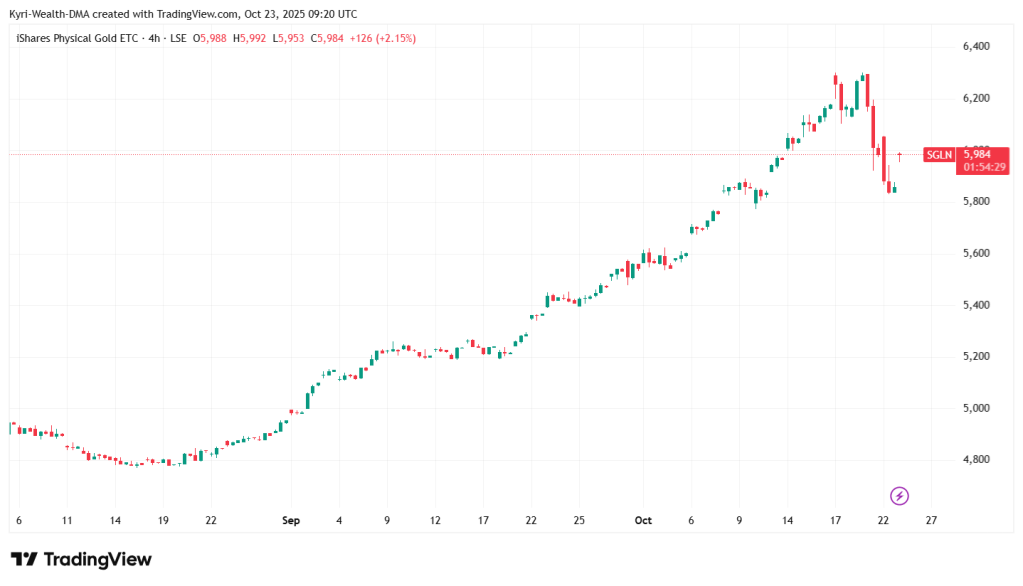

SGLN – iShares Physical Gold ETC (LSE): 5,986p | YTD +31%

DAGB – VanEck Crypto & Blockchain Innovators UCITS ETF (LSE): £12.12 | YTD +40%

MAST – Mast Energy Developments (LSE): Speculative | Early-stage flexible power developer

Every market cycle has a whisper stock — that name everyone swears will 10x before the market wakes up.

This year, that whisper is Mast Energy Developments (LSE: MAST).

The pitch sounds perfect for 2025: Britain’s AI build-out is moving faster than the power grid can handle. Google, Amazon, Microsoft — all are pouring billions into UK data centres. But energy supply is the choke point. Nuclear is slow, renewables are intermittent, and batteries can’t bridge the gap alone.

That’s where MAST claims its edge — fast-start, modular power sites that can fire up instantly to stabilise the grid. Nine projects, about 48 MW combined capacity, and an ambition to scale beyond 100 MW. On paper, it’s the right story at the right time.

The problem? Stories don’t scale — execution does.

MAST is relevant, but not yet ripe. Funding cycles are tight, project timelines long, and liquidity thin. It sits in that grey zone between concept and cashflow — exciting, but speculative.

So while retail money is still chasing “AI-energy” moonshots, the smart money is already deployed — in liquid, high-momentum ETFs that are actually working.

1. VanEck Defence UCITS ETF (DFNG)

This has been the stealth winner of 2025 — up more than 70% year-to-date. It’s the purest way to own Europe’s re-armament boom. Inside are BAE Systems, Rheinmetall, Leonardo — the companies building the kit governments are panic-ordering.

Why it works: policy certainty and multi-year contracts. Defence isn’t cyclical anymore; it’s strategic.

The risk: peace breaks out faster than the market expects.

2. iShares Physical Gold ETC (SGLN)

Gold’s been quietly making all-time highs as inflation sticks and yields plateau. It’s the oldest hedge in the book — and it’s working again.

Why it works: the one asset that doesn’t rely on policy, tech, or sentiment.

The risk: dead money in a full-risk rally.

3. VanEck Crypto & Blockchain Innovators UCITS ETF (DAGB)

Forget meme coins — DAGB is the infrastructure trade. Miners, chipmakers, and digital asset platforms powering the institutional crypto era. Bitcoin’s halving, ETF approvals, and demand for compute have turned it into one of the year’s most explosive performers.

Why it works: it owns the picks and shovels, not the hype.

The risk: 30–50% drawdowns are standard issue here.

Where MAST Fits

To be fair, MAST’s theme isn’t fantasy. Britain genuinely needs flexible generation as AI data centres multiply.

If the company secures a hyperscale power deal or hits its 100 MW milestone, the price could move violently — because there’s almost no competition in its niche.

But until that happens, MAST is best seen as a satellite position — an option on a real trend, not a foundation for a portfolio.

For most investors, the ETFs above already deliver the same macro exposure — energy security, real assets, and digital infrastructure — without the liquidity risk.

Kyri’s Take — A Realistic £100K Split

If I had £100K to deploy right now, here’s how I’d slice it:

- £40K → DFNG — structural tailwind, strong trend, and policy clarity.

- £30K → SGLN — protection against inflation and instability.

- £20K → DAGB — high-beta play on the next liquidity cycle.

- £10K → MAST — speculative optionality on the AI-grid theme.

That mix gives you exposure to what’s already working, plus a little juice if the AI-power story finally catches fire.

Final Line

MAST might be the rumour. But the real money’s already long the themes that deliver.

Leave a comment