If you had £10K spare, where would you put it right now?

Not hypothetically — properly, today.

The easy answers are still doing the rounds.

Property if you like bricks. Cash if you like sleep. Tech stocks if you like noise.

But the smart money — the quiet, early money — has started drifting into something less obvious: rare earths and strategic metals.

These are the elements behind everything that makes the world tick. EV motors, wind turbines, AI chips, drones, defence systems — all rely on the same small list of materials.

Without them, the modern economy doesn’t move.

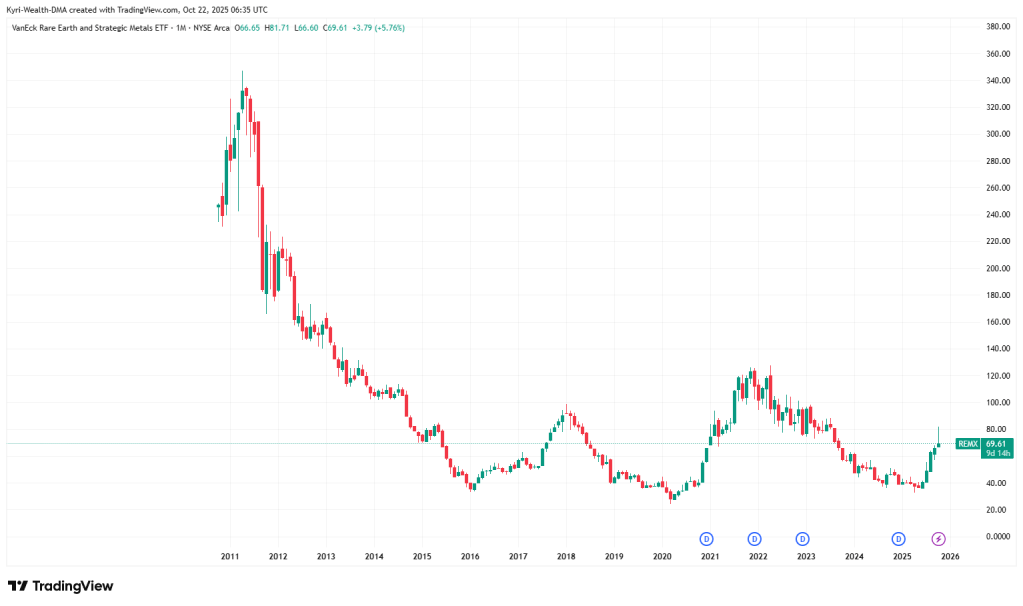

So when you look at the chart of REMX — the VanEck Rare Earth & Strategic Metals ETF — and see it clawing its way back from $30 to about $69 this year, up around 90%, you have to ask: is this just a bounce, or the start of something structural?

The Case

Let’s start with the basics. Rare earths aren’t rare — but refining them is expensive and messy.

China still controls around 60% of global processing. Every time Beijing tightens the tap, global prices jump.

Meanwhile, the West is spending billions trying to onshore supply. That means years of capital expenditure, politics, and supply tension — all bullish for the underlying miners.

REMX gives you a clean way to play that without betting on a single name. You get US, Australian, and Asian exposure, all rolled into one trade. Top holdings include MP Materials, Lynas Rare Earths, and Albemarle.

Expense ratio: 0.58%.

Performance: +90% from the spring lows.

The Reality

You’re not buying a bond here. This thing moves.

In 2021, REMX topped near $130. By early 2024, it was below $40. It’s high beta, cyclical, and moves with China headlines.

But the key difference now? The world’s consumption drivers — AI, electrification, and defence — are all pulling demand higher at the same time.

That’s new. That’s structural.

If you put £10K here today, you’re not chasing yield — you’re buying optionality.

You’re giving yourself exposure to the physical backbone of AI, EVs, and green energy.

You might not double your money next month. But if you’re thinking in 12–24 months, the setup’s clean: mid-cycle, strong demand, limited supply.

Kyri’s Take

If it were me, I’d size it sensibly — £10K max. Treat it like a satellite play, not your core.

Buy, hold, forget about it until it doubles or halves — whichever comes first.

And if it halves, it’s probably time to buy more.

You can access REMX directly through EXANTE — global DMA, no custody fees.

👉 https://exante.eu/p/39557/fromkky/

Because sometimes, the best trades aren’t about timing.

They’re about owning what the future can’t run without.

Leave a comment