If £100K hit your account today, where would you put it?

Not theory, not hype — real allocation in a market that’s both inflated and fragile.

AI stocks are still inflated, gold’s on a tear, crypto’s testing political gravity, and UK property looks more like a savings account than an asset class.

This isn’t about being clever. It’s about being liquid, calm, and in control.

1. AI & Semiconductors — the crowded trade

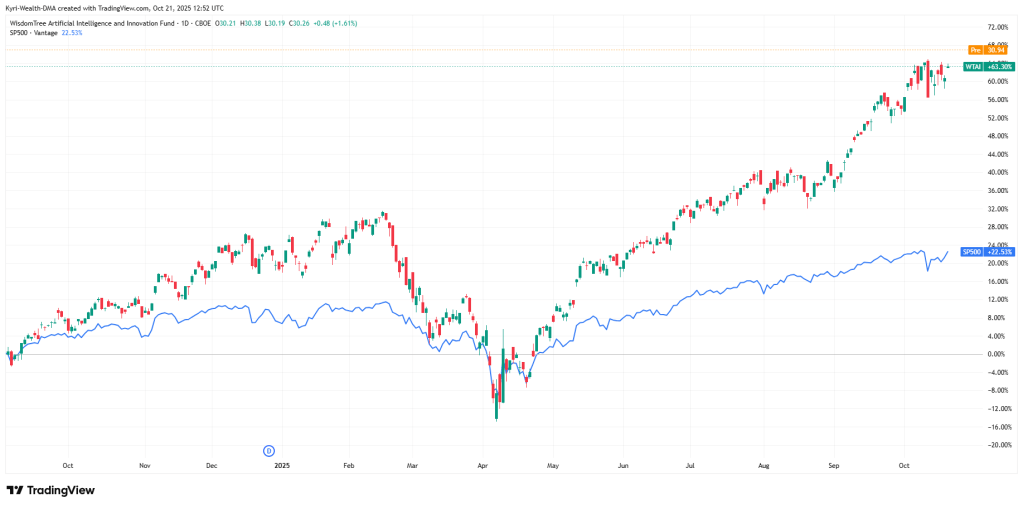

AI’s the new electricity, apparently. But the WisdomTree Artificial Intelligence & Innovation ETF (WTAI) is already up around +63% YTD, while the S&P 500’s up about +22%.

Valuations are stretched — WTAI trades at P/E ~61, P/B ~6.5. That’s not an entry; that’s a latecomer’s risk.

Even Nvidia looks tired.

The smart money’s already rotated into semiconductors and defence instead of pure AI exposure.

Position sizing: Small allocation, if any. Wait for a pullback — or buy the infrastructure (chips, compute, energy) that fuels AI instead of the headlines.

Chart:

AI ETF vs S&P 500 — WTAI up +63% YTD vs +22% for the index. That gap tells the story.

(from your first uploaded chart)

2. Rare Earths & Defence — the quiet beneficiary

Rare earth metals are back in play.

Geopolitics and industrial policy are colliding — China tightening exports again, the West subsidising production.

Funds like VanEck Rare Earth/Strategic Metals (REMX) and Global X Lithium (LIT) were gutted after 2021 but now trade on more realistic multiples.

The new arms race isn’t theoretical — it’s industrial. The smart play isn’t predicting war; it’s owning the inputs to one.

Position sizing: 10–15% of equities, diversified across miners, battery metals, and defence contractors. Volatile, but real.

3. Gold & Bitcoin — the inflation twins

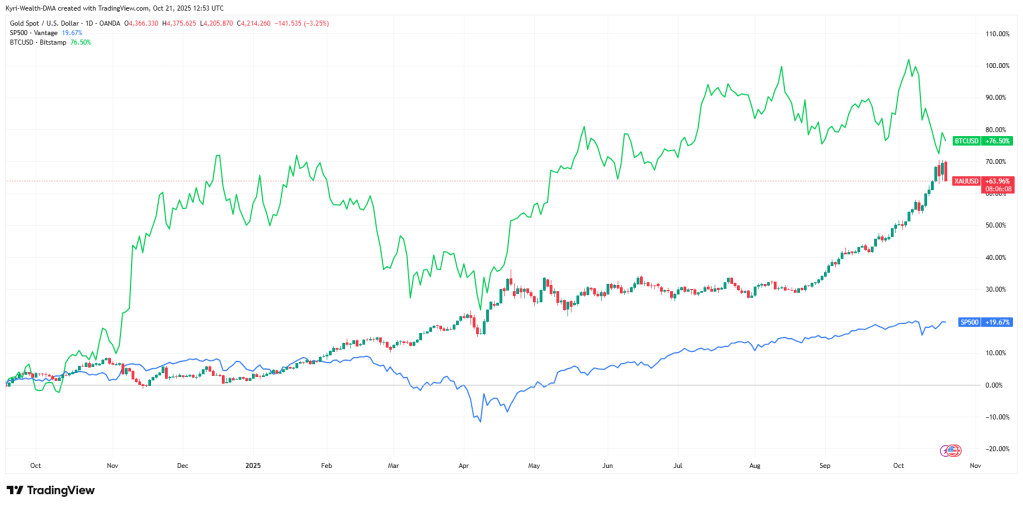

Gold’s done its job.

As of this week, it trades near $4,340/oz, up roughly 60% YTD. Bitcoin sits around $107,000, up about 76% YTD.

Both are benefiting from the same driver — falling real yields and governments losing fiscal discipline.

Gold is still the hedge; Bitcoin is still the leveraged version.

Allocation logic:

- Gold (10%) — stability, liquidity, crisis hedge.

- Bitcoin (10%) — volatility, conviction, asymmetric upside.

Together, they’re insurance against central bank fatigue, not speculation.

Chart:

Gold and Bitcoin vs S&P 500 — both outpacing equities as real yields slide.

(from your second uploaded chart)

4. UK Property — flat but functional

UK property’s in a holding pattern.

Annual growth sits around 2.8% according to the ONS, with average prices near £271,000.

That’s below inflation (CPIH ~ 4.1%), meaning real returns are negative.

If you own outright, it’s fine — it protects nominal value.

If you’re borrowing, the maths breaks quickly: higher rates, tighter credit, heavier tax.

Chart:

12-month UK house-price change, 2015–2025 — post-COVID spike gone, modest recovery but still lagging inflation.

(from your Statista chart)

Position logic:

Only buy with cash, in strong rental zones or quality postcodes. Otherwise, your liquidity’s better elsewhere.

5. Cash & Gilts — the boring alpha

Cash isn’t trash anymore.

Short-term UK gilts yield 4.7–5%, money-market funds the same.

No drawdowns, no drama, full flexibility.

In 2025, that’s alpha — because when the next dip hits, you’re the one with dry powder.

The 100K Allocation That Makes Sense

| Category | Allocation | Rationale |

|---|---|---|

| Cash & Short Gilts | 50% | Liquidity, flexibility, 5% yield |

| Global ETFs (semis, defence, rare earths) | 20% | Real exposure to structural trends |

| Gold | 10% | Inflation hedge |

| Bitcoin | 10% | Optionality and asymmetry |

| Property / REIT | 10% | Tangible, low-leverage play |

Kyri’s Take

The difference between smart money and loud money right now is liquidity.

Everyone wants to predict the next boom.

The best investors are waiting for it — in cash, with options open.

It’s not about being early. It’s about being ready when everyone else panics.

Leave a comment