After months of calm, markets are finally waking up.

The S&P 500’s fourth bull year has been smooth sailing — until now. This week brings real catalysts: Tesla, Netflix, and a delayed CPI print. Together, they’ll test whether this bull still has legs or if we’re due for a volatility cycle.

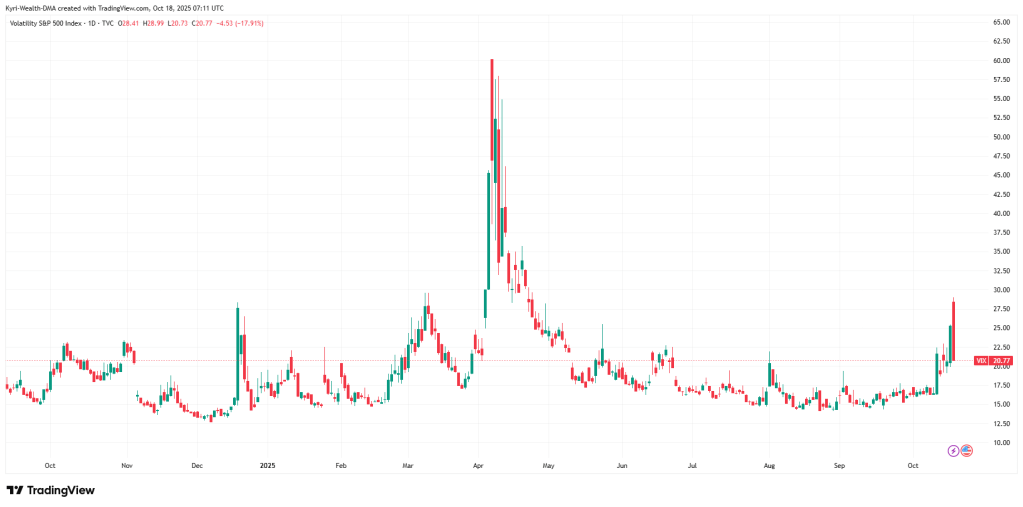

The VIX just hit a six-month high.

For most investors, that’s fear. For traders — that’s fuel.

The Calm Broke — Now Comes the Catalyst

This isn’t a meltdown. It’s a repricing of certainty.

Last week, the U.S. reignited trade tensions with China, threatening new tariffs over rare-earth exports. Add fresh credit concerns from regional banks, and you’ve got the first real stress test since summer.

Yet the S&P 500 is only 1.3% off record highs.

Look closer though — market breadth is thinning fast.

In July, 77% of stocks were in uptrends. Now it’s 57%. Leadership is narrowing, and that’s the classic signal that volatility is about to accelerate.

Tesla, Netflix, and the CPI Wildcard

Three events shape the week ahead:

- Netflix (Tuesday): The streaming giant will show whether growth is still getting rewarded. A subscriber miss could hit media and ad-tech; a beat could spark a sharp, tradable bounce.

- Tesla (Wednesday): Still the market’s sentiment barometer. Margins and delivery numbers matter less than Musk’s tone. If he sounds cautious, expect a shakeout in high-beta tech.

- CPI (Friday): The delayed inflation print is the macro wildcard. A hot number lifts yields and pressures tech; a soft read invites a short-term relief rally. Either way — volatility expands.

Trade the reaction, not the prediction.

How to Trade This Tape

This is a trader’s market, not an investor’s comfort zone.

The setups are clean but fast:

- Fade the stretched megacaps — names like TSLA, NVDA, MSFT where positioning is crowded.

- Rotate into defensives when fear spikes — staples, utilities, and healthcare tend to catch flows.

- Work the ranges — the S&P and NASDAQ are offering daily two-way action again.

This isn’t about calling tops — it’s about capitalising on volatility.

When markets rediscover risk, liquidity fragments, spreads widen, and skilled execution wins.

What’s Really Happening Beneath the Surface

This isn’t a breakdown — it’s rotation under pressure.

Every late-cycle market goes through this phase: leadership narrows, traders get twitchy, and conviction gets tested.

The herd calls it uncertainty.

The pros call it price discovery.

Breadth deterioration is the canary — when fewer names drive the index, volatility spikes because conviction is concentrated. That’s why seasoned traders love these windows. They’re messy, but they move.

KyriWealth Thesis

We’re not at the end of the bull — we’re in its stress test.

Volatility isn’t danger; it’s the reset button for opportunity.

So the playbook is simple:

- Respect risk.

- React faster than the crowd.

- Let price action lead — not prediction.

When everyone else freezes, pros trade.

Because this is where the real money moves.

Trade takeaway:

Volatility is back — don’t fear it, ride it.

Watch $TSLA, $NFLX, and Friday’s CPI for direction cues.

In fast markets, speed and discipline beat conviction every time.

Leave a comment